As it occurs with many disruptive technologies, drones (technically known as Unmanned Aerial Vehicles {UAVs}) owe their development to the defense industry. In the last couple of years we have witnessed the widespread adoption of this technology for civilian use. Governments are adjusting airspace regulations to accommodate drones and pioneering companies are releasing commercial UAV products.

Expectations are high for the emerging UAV industry. According to a study commissioned by the UK Government [1], the civilian UAV market could be $400 billion by the end of the decade. Google and Facebook have both acquired their own UAV manufacturers, Titan Aerospace and Ascenta respectively.

How fast is this technology growing?

Let’s take a panoramic flight over the current technological landscape related to drones.To do so, first we carry out a search for UAV related patents in the IFI Claims comprehensive global patent database. Built on the Fairview Research Alexandria platform, the database combines information from multiple national and international sources into a single normalized database. The database is accessed through the CLAIMS Direct patent web service API.

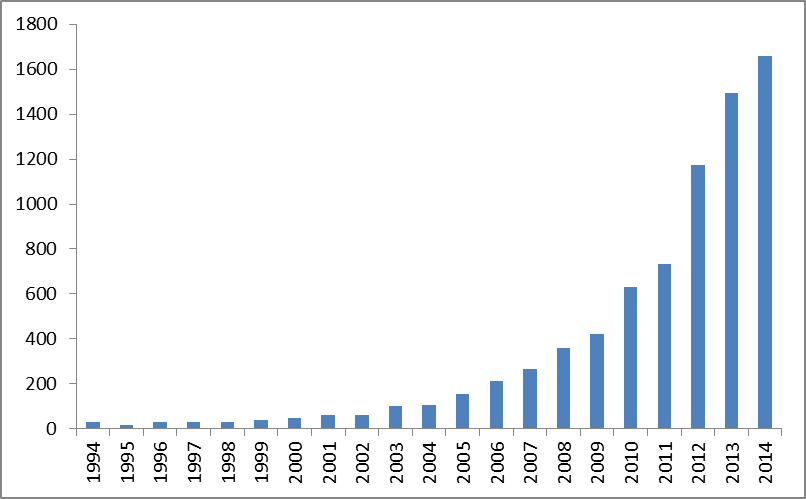

We obtain a total of 7,670 published documents (including 4,357 patent applications, 1,736 utility models and 1,309 granted patents). Figure 1 shows the evolution in the number of published patents.

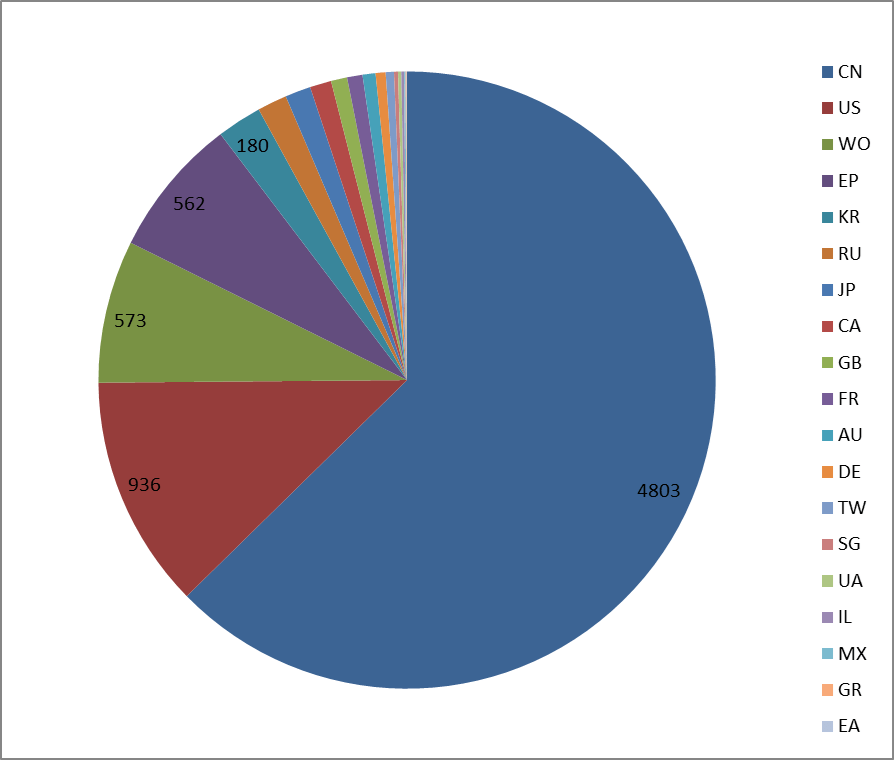

Figure 2 shows the distribution of patent documents by application country. China is the source of the most drone related patent applications. Since 1994, a total of 4,803 patent documents have been published by the Chinese Patent Office (2,456 applications, 1,718 utility models). 629 have been granted so far (a significant number of them (278) during the last 2 years).

Applications in the US nearly reached a thousand, whereas European and PCT Worldwide applications surpassed five hundred in both cases.

As for the rest of the countries, South Korea, Russia, Japan, Spain, Canada, France and the UK, France, Australia, Germany and Taiwan all active in this technology.

Regulations and legislation related to drones are either non-existent or very limited. Rules vary country to country. The ultimate size of the commercial drone market, and the success of drone manufacturers, will be determined by the nature of the final regulations. In the US, for example, the Federal Aviation Administration (FAA) has so far only given six film and television companies permission to use unmanned aircraft for film-making purposes [2].

Who are the main players and what technologies are they developing?

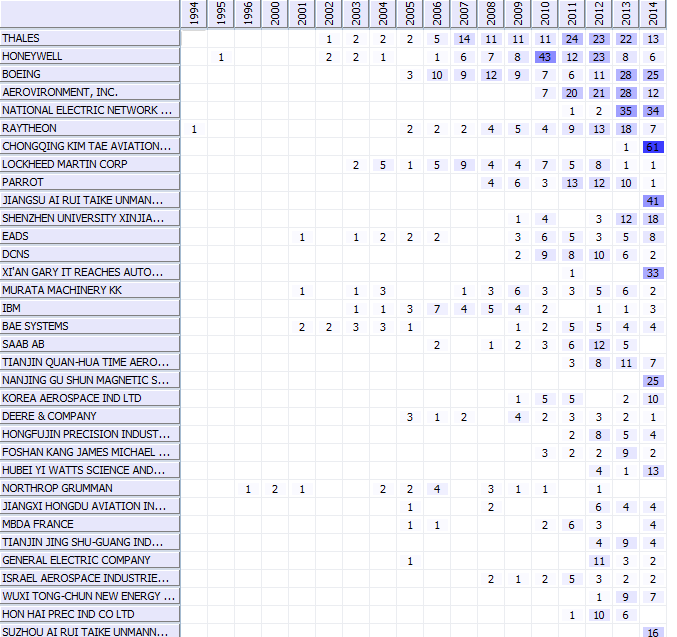

Leading aerospace and defense contractors have pioneered the development of Unmaned Aerial Systems and still occupy the top positions in the list of patent holders. Aerospace and defense group Thales has more than a hundred patents documents filed on flight management and communication systems for UAVs. Honeywell follows with similar number of filed patents on different kinds of special use aircraft (international patent class: B64C 39/02). Aerovironment a pioneer in human-powered flight is filing patents on aircraft using automatic pilots (B64C 13/18), adjustable wings (B64C 3/38) and other related equipment (B64D 47/00). Boeing and EADS are also important players in this field and are active in several technology areas. EADS’s developments on radars for mapping (G01S 13/89) are noteable; Boeing has patented technology on navigational instruments (G01C 21/00) and measurement arrangements (G01D 1/06). Raytheon [3] with 67 patents and Lockheed Martin [4] (52) have been developing technologies related to ground or aircraft-carrier-deck installations and technologies for arresting, launching or towing gear (B64F). These two companies have jointly teamed for several years within the US Unmanned Aerial Vehicle program along with General Atomics, a company which commercializes the Predator drone, well known for its deployment by the US army in the battlefield. Another top player in this domain is BAE Systems which is active in aircrafts and rotocrafts (B64C 27/10) and programme-control systems using digital processors (G05B 19/042). Elbit Systems, Israel’s largest arms company and one of the world’s leading exporters of UAVs is also in the top applicants list. Its leading product is the Hermes 450 drone. In 2005 Elbit had also partnered with Thales UK in the joint Venture UAV Tactical Systems Ltd (U-TacS), for the development of the Watchkeeper WK 450 UAV. Elbit owns patents on unmanned air vehicles and methods of landing them (US20060006281A1, AU2009200804A1, EP1784331A1, IL177185D0, CA2659678A1, SG154440A1), and also on apparatus control for obtaining images (ES2376298T3), for extending the operational electronic range of a vehicle (CA2662299A1), and for flight control during stall susceptibility conditions (WO2012101645A4). Northrop Grumman has less patent activity and is focused mainly on target-seeking control (G05D 1/12).

A new class of civilian focused UAV manufacturers have emerged in recent years. Parrot of France is an example. Parrot is today a very active applicant with about 50 patents on remote control arrangements using wireless transmission (A63H 30/04), radio links (G08C 17/02), helicopters, gyroplanes (A63H 27/133) and toys aircrafts (A63H 27/00), equipped for control of attitude (G05D 1/08).

IBM is also present in the UAV technology space. IBM develops technologies for navigation instruments (G01C 21/00), and methods for control of position, course, altitude, or attitude of land, water, air, or space vehicles (G05D 1/00). Other relevant applicants are American companies such as Florida Turbine Corp, Rockwell Collins, ITT Manufacturing, Excelis ; France’s SAFRAN group (represented for SNECMA and SEGEM Defense as patent assignees) and the French Naval Defence and Energy Group DCNS. Japan’s Murata specialises in programme-control systems based in sequence controllers or logic controllers (G05B 19/04) and in control of position or course in two dimensions (G05D 1/02).

The patenting activity carried out by research institutions is overwhelmingly dominated by Chinese institutions; Beijing University of Aeronautics and Astronautics is the absolute top institution in terms of registered patents. Alone it has filed 267 patents. Leading institutions outside China include Israel’s Technion University and the Massachussetts Institute of Technology.

Collaborations in Drone development

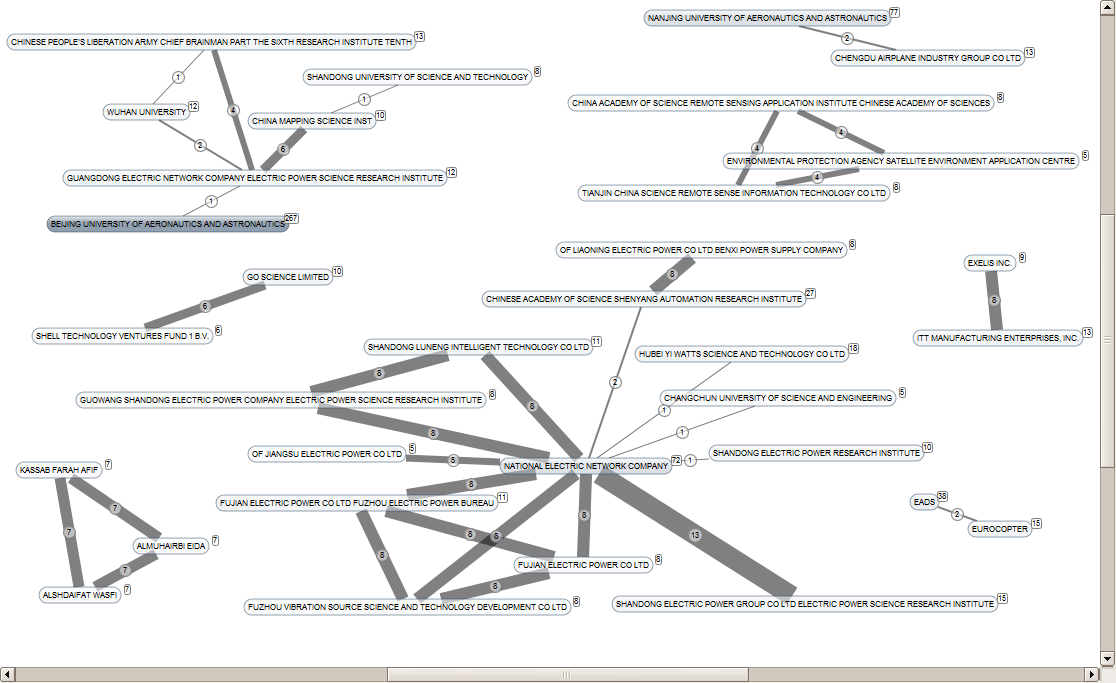

The patent data we have gathered allows us to identify collaboration amongst several organizations. We identify, for example, Chinese institutions such as National Electric Network Company which is co-assignee along with several other Chinese companies and research institutions (see figure 5 below) of inventions related to unmanned devices for power inspection, amongst others.

In the field of Energy, multinational company Honeywell collaborates with US based aerospace engineering and software development firm Avid Llc. (), which carries out multidisciplinary aircraft design and analyses. Both companies own granted patents in the USA (US8240597B2) for ducted fan air-vehicles. Similarly, Shell co-patents with UK based developer of autonomous underwater vehicle Go Science Limited, on an annular airborne vehicle provided with a propulsion system (granted patent US8408489B2).

Israeli institutions Technion Res & Dev Foundation and University Carmel Haifa partner together for the protection in Europe of developments related to UAV decision and control systems (EP1974305A4).

Japan’s Toyota Motor has an international application filed with Canada’s Uti limited Partnership on vehicular navigation and position systems (WO2007143806A2). Sarnoff Corporation co-patents with SRI International in the USA on methods and apparatus for capture and distribution of broadband data associated with intelligence information garnered from an aerial vehicle (US20090012995A1). There is also co-patenting between ITT Manufacturing and its spinoff Exelis. In Europe, EADS group partners with Eurocopter (now Airbus Helicopters) on an aircraft propulsion architecture integrating an energy recovery system (US20140290208A1).

Landscape overview of patented technologies related with drones

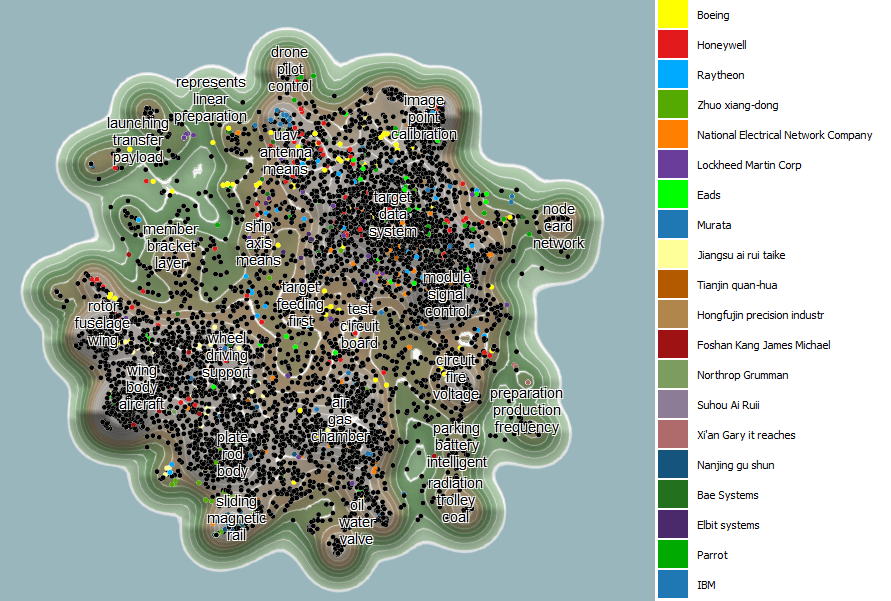

The map in Figure 6, generated with Treparel’s big data and text analytics software KMX, offers a panoramic view of the topic areas covered by all UAV related patents.

Each dot in the map represents a patent document. Patents closely grouped are patents disclosing similar content whereas patents separated from others or isolated are patents disclosing unrelated topics. Some differentiated topic areas or subject groups can therefore be distinguished from the overall patent dataset representation. We note, for example, two main dense groups side by side: A first one in the lower left area of the map where we have inventions dealing with mechanical issues, transportation, wheels, rods, etc. and another main group (in the upper right area of the map) with patents related to means for gathering and managing data, signal controlling, etc. The map also indicates through colored dots who is working in each area (main players), as referenced in the legend.

Figure 6: Patented topic areas. Map generated with Treparel’s KMX text mining Software and IFI CLAIMS patent data.

We now take a closer look at patents filed during the last 2 years (2013 and 2014) for a better perception of current developments. For this purpose, we have used KMX’s classification and highlighting capability to classify patents in application areas of “surveillance”, “agriculture”, “satellite”, “transport”, “solar”, “military” and “combat”).

Figure 7: Patented topic areas during the latest 2 years (patents published during the period 2013-2014). Map generated with Treparel’s KMX text mining Software and IFI Claims patent data.

Clearly emerging technology areas are:

| B64F 1/02 | Ground or aircraft-carrier-deck-installations and arresting gear (specifically Liquid barriers) |

| G05D 1/10 | Automatic pilots with simultaneous control of position or course in 3D |

| B64D 47/08 | Arrangements of cameras for fitting in or to aircraft |

| H04N 5/232 | Devices for controlling television cameras, e.g. remote control |

| G05B 13/04 | Adaptive control systems involving the use of simulation models |

| B64C 27/02 | Gyroplanes |

| B64D 1/18 | Spraying, e.g. insecticides |

| B64C 1/00 | Fuselages such as wings or stabilising surfaces |

| B64C 1/14 | Windows, Doors |

| B64C 1/06 | Frames |

| B64C 1/22 | structures to facilitate loading |

| B64C 25/04 | arrangements of alighting gear on aircraft |

| B64C 25/10) | retractable or foldable undercarriages |

Emerging Companies

Chinese institutions are taking the lead in terms of recent patent activity on UAVs. National Electric Network Company has registered more than 70 applications only in the last two years; another strong newcomer is Chongqing Kim Tae Aviation which operates in the field of unmanned aircraft for agriculture and has filed 61 applications only in 2014.

Top Chinese inventor Zhuo Xiang-Dong alone owns more than 60 patents applications; XI AN FEISIDA AUTOMATION ENG has 33 applications just in 2014; NANJING JIUSHUN MAGNETIC LEVITATION TECHNOLOGY CO LTD has filed 25 applications in 2014 on ground or aircraft-carrier-deck installations using catapults (B64F 1/06); Jiangsu ai rui taike unmanned aircraft science and technology co ltd, has 41 applications in 2014 and Suzhou ai rui taike unmanned aircraft science and technology co ltd has16 in 2014; Hubei Yi Watts Science has 16 applications and utility models on unmanned engines in 2014. Finally, DJI with its flagship products Phantom and Inspire One has a record of 20 patents published during the last two years under assignee names Shenzhen Dji Innovations (in China) and Sz Dji Technology Co Ltd in the US, Korea, Japan and Mexico. Note that the applicant names shows above are based on statistical machine translation.

Figure 8: Patenting evolution throughout the years (publication date) of main players. Matrix generated with Matheo Analyzer and IFI CLAIMS patent data.

Emerging Drone Startups

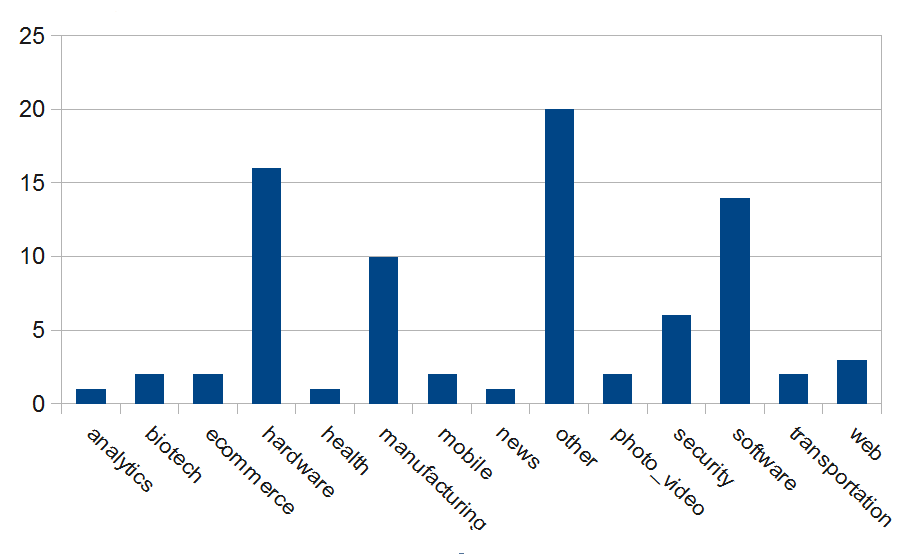

To complete our overview of drone related innovations, we draw on CrunchBase and Angelist, the world’s two most comprehensive datasets of startup activity. We check for startups that explicitly develop products or technologies related to UAVs. Figure 9 shows the main associated categories.

Figure 9: Number of startups grouped by categories Source: Crunchbase.

Startups operate in the major segments of hardware, software and manufacturing. They also provide differentiated services including security, transportation, ecommerce, health and biotech, photo/video and analytics.

In the table below we list the top UAV startups sorted by amount of funds raised.

Amongst these startups, only Prioria and Precision Hawks have patented technologies: PrecisionHawk has patented an Unmanned Aerial Vehicle in the US and Canada under the applicant name of Winehawk Inc and Precisionhawk inc (CA151099S, USD706678S1); Prioria has filed an international PCT application for a system and method for onboard vision processing (WO2007047953A2).

Table 1: Top Drone Startups. Source: Crunchbase and Angelist

| Company name | Description |

| 3D Robotics http://3drobotics.com/ |

3DR is a North American personal drone company, known for pioneering advanced and easy-to-use consumer drone technology, and for the Pixhawk, a popular autopilot platform. All 3DR drone systems also serve as robust tools for data analysis, enabling mapping, surveying, 3D modeling and more. 3DR technology is currently used across multiple industries around the world, including agriculture, construction, infrastructure, search and rescue and ecological study. Founded in 2009 by Chris Anderson, former editor-in-chief of Wired Magazine and founder of DIYDrones.com, and Jordi Muñoz, an engineering prodigy from Ensenada, Mexico, 3DR is a VC-backed startup with over 200 employees in North America and more than 30,000 customers worldwide. Headquartered in Berkeley, CA, it operates engineering facilities in San Diego, sales and marketing in Austin, Texas, and manufacturing in Tijuana, Mexico. Funds raised: $35M |

| Airware http://www.airware.com |

In 2011, Airware identified a significant gap in the market. Military autopilots were too inflexible and expensive and hobbyist projects weren’t safe or reliable enough for commercial use. For the growing number of diverse commercial applications, the industry needed more than an autopilot. Airware’s Aerial Information Platform enables customers to tailor UAS to any commercial application by seamlessly connecting airframes, actuators, sensors, payloads, and application-specific software. Funds raised: $13.7M |

| Skycatch https://www.skycatch.com |

Skycatch is a platform for capturing data at scale using small autonomous aerial robots. Its product is built for the enterprise with safety, strength and reliability in mind. It can cover large geographic areas, it can be equipped with a wide range of different sensors depending on the customer’s needs and it can operate in challenging weather conditions. Its proprietary battery-swapping and autonomous landing technology gives its aerial robots the ability to scale and operate without human involvement. Funds raised: $13,3M |

| Crossbow Technologies http://www.moog-crossbow.com |

Crossbow Technology, Inc. (also referred to as XBOW) was a California-based company with two distinct product lines. One is based on sensors and fibre optic gyroscope inertial sensor systems. This includes inertial measurement units, attitude and heading reference systems, digital inclinometers and guidance, navigation and control units. The other is based on GPS and radios using cellular phone technology with multiple environmental sensors that includes asset tracking products. Funds raised: $13M |

| Precision Hawk www.precisionhawk.com |

PrecisionHawk’s mission is to provide to its clients with user-friendly tools that allow them to efficiently and consistently collect and process high quality data. They seek to become the top of the data pipeline and work coherently with existing workflows, instead of forcing users to start new processes from the ground up. Funds raised: $11M |

| SintecMedia www.sintecmedia.com |

SintecMedia designs and implements innovative management systems for the broadcasting, cable and satellite industries. OnAir is an all-in-one solution that manages airtime sales and traffic operations as well as content acquisition, broadcast rights, long-term and detailed schedule planning, and promotion planning. Funds raised: $10M |

| CyPhy Works http://cyphyworks.com |

Company that develops small hovering robots designed for inspection and ISR (intelligence, surveillance, and reconnaissance) Applications and Aerial Reconnaissance and Communications matge designed to provide long term persistent stare capabilities and enable reliable long distance Communications. Funds raised: $9.95M |

| Prioria Robotics http://www.prioria.com |

Prioria Robotics is a developer of small unmanned aerial vehicle systems and related technologies, most notably the Maveric, a breakthrough composite carbon fiber UAV. Prioria delivers high-tech products and services to civilian and commercial markets and to our nation’s military. Prioria was founded in 2003 by a group of ambitious University of Florida graduates. In 2008, Prioria launched the Maveric UAS. In 2012, the FAA began to open public airspace for unmanned system operation. Prioria began aggressively pursuing commercial applications and leveraging its capabilities into that emerging marketplace. Prioria also provides engineering solutions for industrial and ground robotics, medical device manufacturers, homeland security applications and other cutting edge commercial products. Prioria utilizes the underlying technologies and components of its unmanned systems to provide solutions to an assortment of other complimentary markets. Funds raised: $9.78M |

| Proxy Technologies www.proxytechnologiesinc.com |

Incorporated in 2005, Proxy Technologies® is a U.S. Small Business corporation headquartered in Reston, Virginia. In 2012 Proxy changed its name from Proxy Aviation Systems to Proxy Technologies® recognizing the corporation’s evolution beyond unmanned aircraft. As part of the broadened focus, Proxy Aviation Systems will remain a sub-division under the Proxy Technologies® umbrella and continue to innovate new and pioneering products. Proxy also maintains an Operations Center facility for research and development as well as a Test and Integration facility in Gaithersburg, Maryland. Funds raised: $2.71M |

| Swift Navigation www.swiftnav.com |

Swift Navigation provides centimeter-accurate positioning for agriculture, drones, and construction, anywhere on Earth. Our products deliver 100 times better accuracy than the GPS in your cell phone – at a tenth of the price of the competition. Swift Navigation is enabling a world where fields farm themselves, drones fly safely, and humans lay the foundations of the future.Technology: Real Time Kinematic (RTK) satellite navigation is the industry standard technique used to achieve centimeter-accurate positioning. It uses more accurate measurements of the GPS satellite flight time, combined with a reference station to provide real-time corrections for ionospheric interference, to provide down to single centimeter-level positioning accuracy. Funds raised: $2.6M |

| Pix4D www.pix4d.com |

With over ten years of leading scientific research and founded in 2011, Pix4D has become the leading provider for professional unmanned aerial vehicle (UAV) processing software. Started as a spin-off of EPFL’s (Ecole Polytechnique Fédérale de Lausanne) Computer Vision Lab in Switzerland, Pix4D is a dynamic and rapidly expanding company and is pursuing its R&D efforts by collaborating with industrial partners as well as EPFL in research projects supported by the Swiss Government. Funds raised: $2.4M |

| PrismTech http://www.prismtech.com |

PrismTech’s customers build system solutions for the Internet of Things, the Industrial Internet and advanced wireless communications. PrismTech supplies the software platforms, tools and services they need to deliver the performance, scalability, efficiency, flexibility and robustness they require. Its customers service many market sectors, including: industry, energy, healthcare, transportation, finance, aerospace and defense. Our products provide support for real-time situational awareness (including Big Data analytics), control and interoperability, through connectivity between: cloud services, enterprise applications, mobile devices and embedded systems. PrismTech Gartner Cool VendorPrismTech utilizes industry standards, open source licensing and product excellence to deliver both performance and cost advantages for our customers. We operate globally and have an extensive portfolio of technology, geographical and vertical domain partners. PrismTech is honored to have been named a 2014 “Cool Vendor” by leading analyst firm Gartner. Funds raised: $2.32M |

| DroneDeploy https://www.dronedeploy.com |

Cloud Control for Drones. DroneDeploy enables you to put drones to work for your business Funds raised: $2. M |

| Maxtena http://www.maxtena.com |

Maxtena designs and manufactures a comprehensive range of embedded, external and custom antenna solutions for GNSS (GPS, GLONASS, COMPASS, Galileo), Iridium, Inmarsat and Thuraya Satellites and Terrestrial M2M, MSS and 4G LTE applications. It provides antenna products and consulting services to businesses, the US and foreign governments, and non-governmental organizations around the world. Our antenna products are ideally suited for portable wireless applications including satellite phones, military radios, hand-held navigation, GPS tracking, recreational devices and laptop computers. Our consulting services include feasibility studies, chamber testing and prototyping. Funds raised: $2. M |

| VIRES Aeronauts www.viresaero.com |

Vires Aeronautics develops high-performance unmanned aerial vehicles that utilize Active Circulation Control (ACC) technology. Our patented design increases the lift capability of fixed-wing aircraft, enabling faster takeoff and landing, increased payload capacity, improved maneuverability, extended range, and reduced fuel consumption. Funds raised: $1,9 M |

| Skyward http://skyward.io |

SkyWard provides a global system of record for managing aerial robotics (AR) flight operations around the world. Cloud-based tools include administrative dashboards for managers and mobile apps for operators, all connected in real time. Unique, portable identities for drones and people give managers real-time visibility on assets in the field; customer requests can be efficiently dispatched; and flight operations can be digitally tracked. Logs for aircraft and personnel are automatically updated as a course of business, and the information flows to the regulator and insurer as needed. Funds raised: $1,5 M |

| Sanswire | Stratellite is a brand name trademark of Sanswire for a future emissions-free, high-altitude stratospheric airship that provides a stationary communications platform for various types of wireless signals usually carried by communications towers or satellites. The Stratellite is a concept that has undergone several years of research and development, and is not yet commercially available; Sanswire, with its partner TAO Technologies, anticipates its current testing sequence to include the launch of a Stratellite into the stratosphere. Sanswire Corp., based at the Kennedy Space Center in Florida, announced that it has unveiled a new lighter-than-air UAS, the “Argus One” following the Company’s recent filing of a provisional patent application. The airship is designed for intelligence, surveillance and reconnaissance (ISR) applications for the US military and other governmental agencies. It is apparently “Newly Designed and Constructed and Ready to Fly” Funds raised: $1.23M |

| Cella Energy http://cellaenergy.com |

Cella has developed a novel hydrogen storage material capable of releasing large quantities of hydrogen when heated to temperatures above 100°C. It can be produced at scale and at low cost in volume production. The material makes the storage and transportation of hydrogen at room temperature and pressure possible and safe. Cella US senior scientists Prof Sean McGrady and Dr Allison Fisher working in the glove box- Cella Energy Ltd is a UK registered company based in Oxfordshire with a wholly owned subsidiary, Cella Energy US Inc., registered in Delaware, USA. Cella has offices and a laboratory at the Rutherford Appleton Laboratory and similar facilities located in the Space Life Sciences Laboratory at the NASA Kennedy Space Center in Florida, USA. As of September 2013, Cella has 11 employees, 2 based in the US and 9 in the UK, 70% being educated to second degree or PhD level. In June 2014, Cella demonstrated hydrogen-powered UAV. Funds raised: $1.15M |

| CYBERHAWK Innovations http://www.thecyberhawk.com |

Cyberhawk carries out aerial inspection and surveying using Remotely Operated Aerial Vehicles (ROAVs) Unmanned Aerial Vehicles (UAV) whether it’s a close visual inspection of a live flare stack, flare tip, live transmission tower or topographic land survey from the air. Its clients are Oil, Gas, Petrochemical and Utility companies, both onshore and offshore, in the UK, Europe, Middle East and around the globe. Funds raised: £1.25M |

| Plexidrone http://plexidrone.com | Plaxidrone produces Quadcopter with Retractable Landing Gear, GPS Follow Me or Follow and object, and Object avoidance and with Plexi-Pack and the quad's portability The company has raised funds in Indigogo crowdfunding campaing. |

Some final remarks

- The worldwide market for Unmanned Aerial Vehicles for commercial and civilian use will be huge, according to all estimations, although the adaptation of legislation will be crucial for the UAV deployment in each jurisdiction.

- Traditional aerospace and armament companies such as Thales, Honeywell, Boeing, Raytheon, Lockheed Martin, BAE Systems, etc. have been investing in the development of UAV related technologies for decades and are still active players.

- Newcomer Chinese aircraft manufacturing companies such as Nanjing gu shun magnetic suspension science and technology co ltd., Xi'an gary it reaches automatically chemical engineering co ltd., Jiangsu ai rui taike unmanned aircraft science and technology co, Suzhou ai rui taike unmanned aircraft science and technology co ltd. or DJI and Chongqing Kim Tae Aviation, are aggressively patenting in the last two years.

- Apart from tradition military use (combat and surveillance applications), drone development is spreading towards other application areas such as Transportation, Agriculture or Energy in which other players such as Parrot are positioning.

- An increasing number of startups from around the globe are appearing, offering innovative technologies and solutions based on unmanned aerial systems.

- Main application areas proposed by startups are manufacturing, security, transportation, ecommerce, health or biotech.

References

[1] Military drones zero in on $400 billion civilian market

http://www.reuters.com/article/2012/11/14/us-science-drones-civilian-idUSBRE8AD1HR20121114

[2] Weekly Trend: U.S. Still Hovering Behind the Rest of the World on Drones

http://1776dc.com/news/2014/10/16/weekly-trend-u-s-still-hovering-behind-the-rest-of-the-world-on-drones/?utm_content=bufferf76df&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

[3] http://www.flightglobal.com/news/articles/raytheon-and-general-atomics-team-up-to-integrate-mald-onto-382308/

[4] http://www.ga-asi.com/news_events/index.php?read=1&id=137

“Why Some Drone Makers Hate the Word ‘Drone’ and Want to Change It” http://online.wsj.com/articles/why-some-drone-makers-hate-the-word-drone-and-want-to-change-it-1412821801?mod=e2tw

COMMERCIAL DRONES: Assessing The Potential For A New Drone-Powered Economy

http://www.businessinsider.com/the-market-for-commercial-drones-2014-2

The Future of the Civil and Military UAV Market

http://www.frost.com/sublib/display-market-insight.do?id=236443867

Get Ready for 'Drone Nation'

http://fortune.com/2014/10/08/drone-nation-air-droid/?utm_content=buffer39f7e&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

These are the people who will build Facebook’s drones

http://qz.com/193045/these-are-the-people-who-will-build-facebooks-drones/

What is the Drone Industry Really Worth?

http://fortune.com/2013/03/12/what-is-the-drone-industry-really-worth/

Unmanned Aerial Vehicle Market (UAV) Worth $114.7B by 2013

http://www.prnewswire.co.uk/news-releases/unmanned-aerial-vehicle-market-uav-worth-1147b-by-2023-245370681.html

The UAV digest

theUAVdigest.com

UAS vision

http://www.uasvision.com/