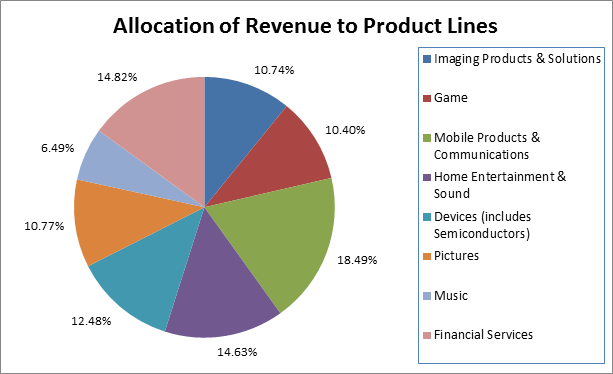

Sony’s 2013 Fiscal Year revenue was $72.3B. In their annual report, Sony allocates this revenue to product lines as shown below.

Sony Corporation's 2013 Product Revenues.

Using data provided by IFI CLAIMS Patent Services, I will attempt to answer the following questions:

- What technologies is Sony investing in, as indicated by patent grants and applications?

- How well do Sony’s intellectual property filings align with product revenues?

| Year | 2010 | 2011 | 2012 | 2013 | Trend | |

| H04N (Television) | 701 | 776 | 1109 | 1126 | 1.53% | |

| G06F (Digital Data Processing) | 428 | 405 | 515 | 578 | 12.23% | |

| G11B (information Storage) | 395 | 369 | 401 | 320 | -20.20% | |

| H04L (Transmission of Digital Information) | 325 | 336 | 379 | 363 | -4.22% | |

| H01L (Semiconductors) | 193 | 251 | 295 | 409 | 38.64% | |

| G09G (Display Devices) | 96 | 148 | 228 | 226 | -0.88% | |

| G06T (Image Processing) | 112 | 100 | 197 | 230 | 16.75% | |

| H04W (Wireless Communications) | 125 | 136 | 145 | 157 | 8.28% | |

| G02B (Optical Elements) | 114 | 127 | 149 | 137 | -8.05% | |

| G02F (Optical Devices) | 111 | 132 | 161 | 116 | -27.95% |

Sony Corporation's Recent Patents by CPC Code.

Semiconductors, Data Processing and Image Processing are the technology areas showing the most growth. Patenting in Information Storage and Optical Devices is declining.

There is no neat correspondence between the technologies and the revenue producing product lines. Sony’s Mobile Communications (cell phone) business is its top revenue source. In terms of technology, almost all of the areas listed above contribute to the IP protection of their cell phone business. The same can be said for gaming consoles, advanced network connected televisions, and digital cameras.

Sony’s strategy seems to be to build IP around core technologies – they then use those patent protected technologies across their entire product line.

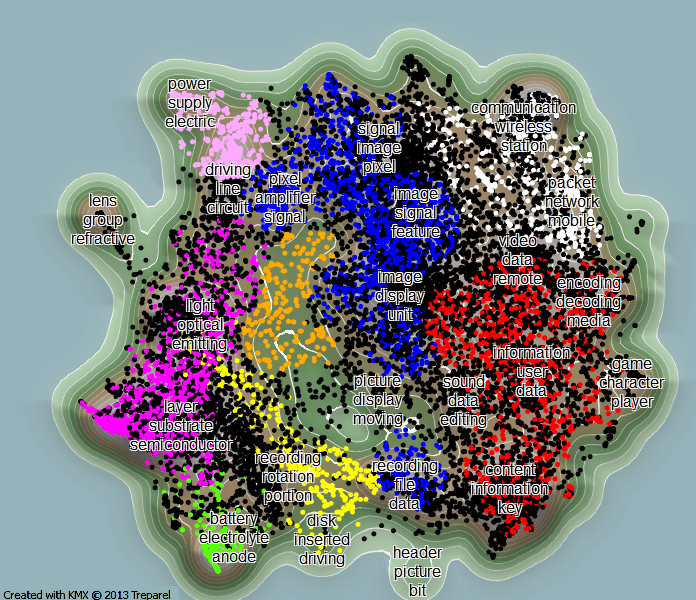

Another way to look at Sony’s recent patents is using landscape visualization. Text analytic tools are able to group complex documents (like patents) together based on similar content. The topic groups can be displayed in a topographic style map. The image below is based on the KMX Patent Analytics tool provided by IFI CLAIMS and Treparel Information Solutions.

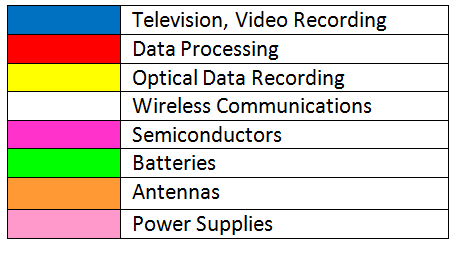

Distinct clustered have been color coded. The legend is shown below the figure. The legend is based on keywords automatically associated with the documents in each cluster – they are not based on patent classifications.

Landscape View of Sony's 2010-2013 Patents and pre-grant Publications.

The KMX visualization identifies the same general technology areas that we see when we look at CPC classifications. Again, distinct “products” do not appear in the landscape, but enabling technologies do.

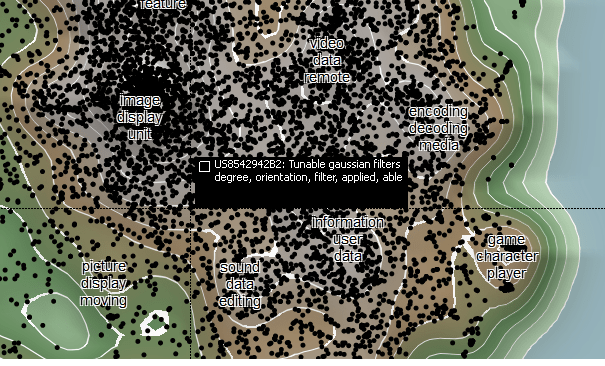

KMX Patent Analytics is particularly well suited to analyzing large patent collections, and for drilling down to gain insight into specific technology areas. Consider the area around the “image | display | unit” cluster. US 8542942 B2, “Tunable guassian filters” published on Sept. 24, 2013, is highlighted in the figure below.

US 8542942 B2, “Tunable guassian filters” in the Patent Landscape.

In the claims of 8542942, Sony specifies that the invention is applicable to the following list of devices:

- a personal computer

- a laptop computer

- a computer workstation

- a server

- a mainframe computer

- a handheld computer

- a personal digital assistant

- a cellular/mobile telephone

- a smart appliance

- a gaming console

- a digital camera

- a digital camcorder

- a camera phone

- a smart phone

- a portable music device

- a video player

- a DVD writer/player

- a high definition video writer/player

- a television

- a home entertainment system

That’s a very comprehensive list that would seem to cover all of Sony’s present and future consumer electronics products.

Given Sony’s broad product strategy, the approach of developing and patenting key enabling technologies, and then using those technologies across multiple products, seems smart. Given Sony’s large patent portfolio, they would appear to be well positioned to compete in all their target markets.