By: Enric Escorsa O’Callaghan, IALE Tecnologia, S.L.

The world’s population is rapidly aging - according to the World Health Organization (WHO), in almost every country, the proportion of people aged over 60 years is growing faster than any other age group. Within 35 years, there will be more people alive older than 60, than there are people younger than 15.

The effects of the population growing older -as indicated in recent studies such as “Understanding the needs and the consequences of the Ageing Consumer” by ATKearning- will be enormous at a social level, as well as in retail and in the manufacturing industries. There is thus and increasing opportunity for these industries to identify the changing needs and expectations of society and provide new goods and services that respond to them.

We wonder what kinds of innovations related to older people are being protected by patents today.

Figure 1. The contents of 5,625 patents related to the elderly

using KMX Patent Analytics.

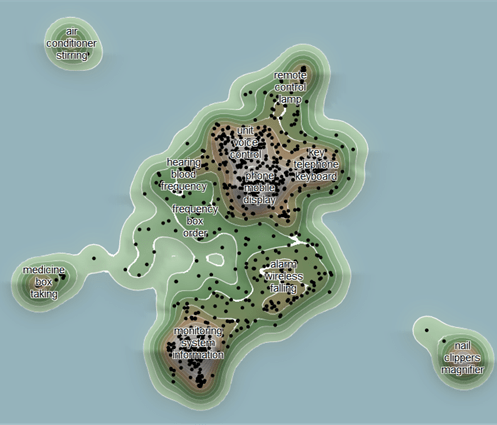

From a first glimpse to the map generated through KMX, we clearly distinguish at least three main differentiated areas: The first one, in the lower central part of the map (yellow circle), is related to orthopedic devices, wheelchair and other vehicles; a second area (circled in blue) does with food and nutrition compositions, and a third main area or patent cluster at the left hand side of the map (circled in red), is related to remote control and monitoring systems.

In order to better outline the patents belonging to each group we can create a KMX classifier. Labeling a few highly representative patents of each group allows KMX to create an automatic classifier based on a user defined set of classification terms. The classifier can automatically assign a classification to all of the documents in this data set – or to any other data set we may produce in the future. Figure 2 shows the result of this classification in the generated colored landscape map.

We can now have a closer look at each of these three main areas to describe them in more detail.

Figure 2. KMX Classification Results for a 3-group custom

classifier against a data set of patents related to the elderly.

Group 1: orthopedic devices, vehicles (crutch, wheel, chair, shoe, walking, stick, rod)

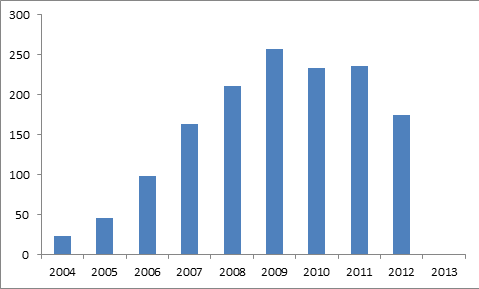

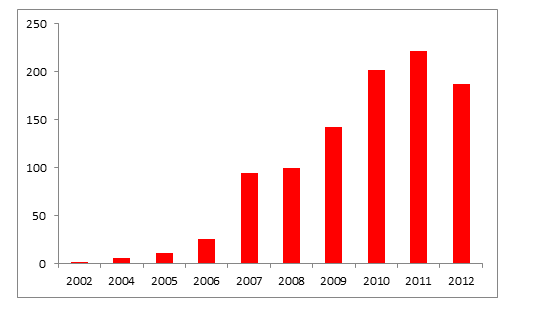

Group 1 is the most representative group, containing up to 2406 documents (571 patents and 1303 utility models). This group contains a large number of utility models issued by the Chinese Patent Office. The rate of patent filings in this group shows a growing trend throughout the years (figure 3).Figure 3. Patentability evolution in Group 1 – Orthopedic Devices.

By taking the patents just from Group 1 and creating a new landscape visualization, we get a better view of the content, as shown in Figure 4.

Figure 4. Content clusters within Group - 1: Orthopedic Devices.

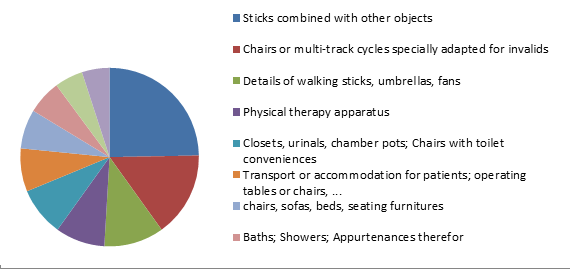

If we look at the IPC code counts for the patents in Group 1, we see different kinds of assisting apparatus (such as walking sticks, wheelchairs, etc.), as shown in Figure 5.

Figure 5. Main IPCs within Group 1 – Orthopedic Devices.

Group 2: food, nutrition compositions (preparation, powder, medicine, food, method)

Group 2 includes 1439 documents (1111 applications and 328 granted patents) related to food and nutrition. We observe thus a comparatively higher number of granted patents in this group and a reduced number of utility models (only 20). Countries where most of the patents have been granted are China (287) followed by Russia (20), US (8) and Canada (6).Following rapid growth, the publication trend has slightly receded in recent years as shown in Figure 6.

Figure 6. Patentability evolution in Group 2 – Food and Nutrition.

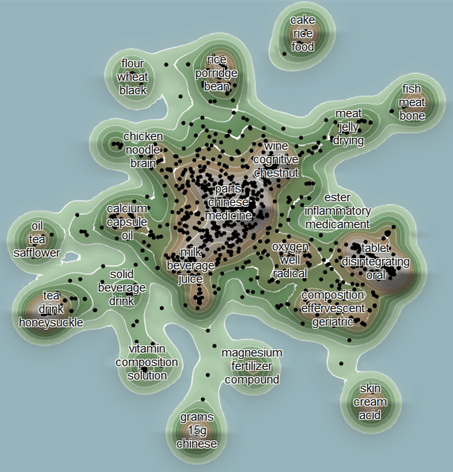

Figure 7 shows a landscape map of the patents in Group 2 – Food and Nutrition. Most of the patents are related to foods and beverages, many of them comprising biologically active ingredients with anti-aging properties, and also traditional Chinese medicines.

Figure 7. Content clusters within Group 2 – Food and Nutrition.

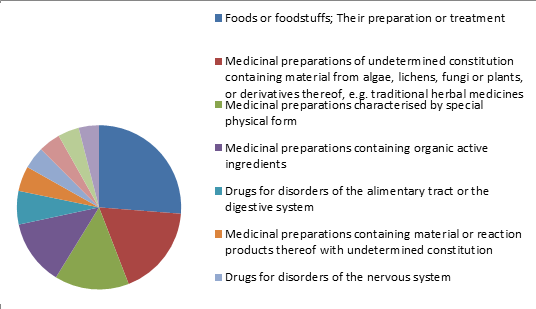

Two main groups according to the IPCs can be distinguished within this group: foodstuff and food preparations on one side, and different kinds of medicinal preparations (mostly Chinese medicines containing herbal or other organic ingredients, etc.).The most common IPC codes in this group are “Foodstuffs and Food Preparatioin” and “Medical Preparations” (mostly traditional Chinese herbal medicines). See Figure 8.

Figure 8. Main IPCs within Group 2- Food and Nutrition.

The most active patent applicants in the food compositions and nutrition group are the multinational Nestec, patenting several nutritional compositions with properties related to skincare and beauty treatments for elderly people, and Quantum high-tech Beijing academe ltd, patenting on orally disintegrating tablets. In Europe CHX technologies has filed patents on dental topical solutions.

Group 3: remote control and monitoring systems (module, system, mobile, phone, information, control)

Finally, Group 3 contains 991 documents (390 applications, 57 grants and 544 utility models). All 544 utility models are Chinese and 121 of them have been granted. This group shows a strong growth (Figure 9).

Figure 9. Patentability evolution in Group 3 – Remote Control and Monitoring.

The main topic areas can be seen in Figure 10.

Figure 10. Content Clusters within Group 3 – Remote Control and Monitoring.

Patents related to different means of setting up secure environments through intelligent systems (alarms) are well represented.

Main applicants within this group are Chinese electronic manufacturing firms such as Dongguan Jieweixun Electronics co ltd., KONKA Group and TCL Corporation from Huizhou. Also included is the South Korean giant Samsung Electronics.

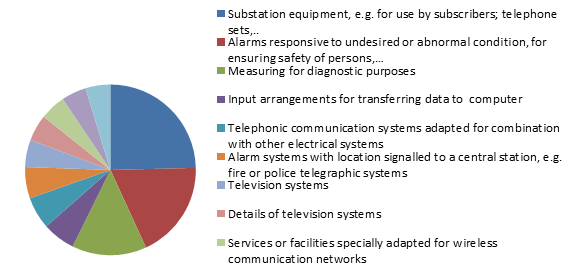

The main areas according to International Patent Classification (IPC) are related to telephone and communication and data transferring systems, as shown in Figure 11.

Figure 11: Main IPCs within Group 3 – Remote Control and Monitoring.

Patents related to ubiquitous tele-assistance or to what is called Ambient Assisted Living (AAL) would fall into this group.

Another important classification is measuring for diagnostic purposes (A61B 5/00). This is an interesting area for its implications in the new user-centered socio-assistance model that is moving from health centers to homes and persons.

Active Chinese companies include Daweixin Invest Consulting (call-for-help devices), Weifang Leiwei Medical Industry Co (remote monitoring devices). Active Chinese universities include the Northeast University, the University of Zhejiang and the University of Fujian. In the United States, the University of Louisville and Kimberly Clark have applied for patents in pressure monitoring skin-adapted tissues. In Japan Okada Hidehito has filings for sensors based on sound for the detection of pharyngeal related problems and Hitachi and Australian Citech Research IP have PCT applications on brain tests specially adapted for elderly people and on bio-activity monitoring devices, respectively. In Korea the Yunlin Company and the National Defense Universities have filed measuring devices for arthritis and RFID smart card based communication systems with an end-care service. In Europe, the Portuguese Clinica Medica Santo Antonio de Joane has filed EP patents on bionic devices regulating mastication problems and the University of Grenoble (France) has an EP granted patent on a method for detecting critical situations based on the measurement of several physiological constants.

Let’s focus in on the group related to diagnostic measuring. We do this by performing another search in the IFI Claims global database for all patents in the IPC class A61B 5/00.

Top players in this field are multinational companies such as Philips Electronics, Medtronic, Olympus Medical Systems, Ethicon Endo Surgery Inc. (from Johnson& Johnson group), UK’s Tyco Healthcare and Warsaw Orthopedic.

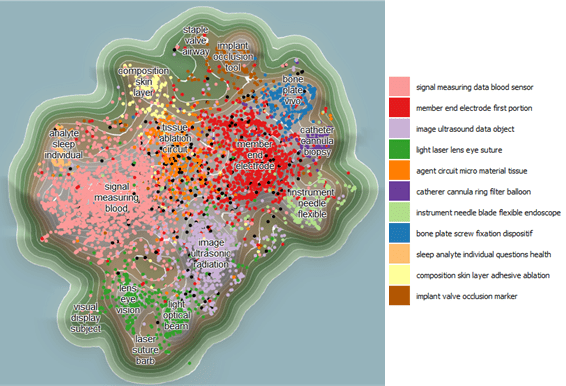

After training the KMX classifier over the patents retrieved, we obtain the map shown in Figure 12.

Figure 12. Patents in IPC Class A61B 5/00 (measuring for diagnosis purposes).

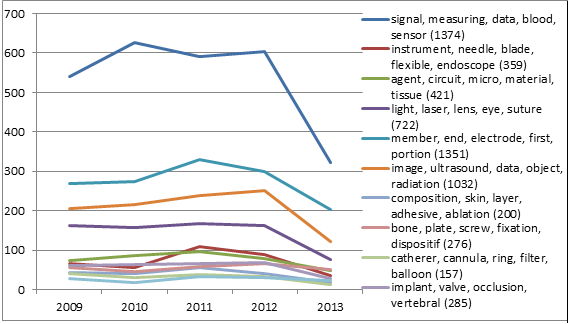

It allows us to identify and group 11 different subareas related to measuring for diagnosis purposes (Figure 13):

Figure 13. Thematic subgroups evolution within A61B 5/00 (measuring for diagnosis purposes).

In the main group (signal, measuring, data, blood, sensor) we found patents such as a body-worn sensor for evaluating falls risks of elderly people living in community dwellings, filed in the US by Intel GE Care Innovations LLC. Philips also registers patents on systems for capturing and delivering medical information configured in conjunction with entertainment devices. The California Institute of Technology protects inventions on prosthetic devices in which control signals are based on the cognitive activity of the prosthetic user; indeed, in other inventions, cognitive rehabilitation techniques are enhanced through interactive graphical user interfaces.

This is just an example of the possibilities of undertaking topic searches on the IFI CLAIMS Global database and analyzing the results with KMX. The IFI CLAIMS database contains a comprehensive collection of Chinese patents, applications and utility models. When these are included, they can have a significant impact on the search results, as we have seen. KMX allows us to see the landscape of the patents related to aging. Most patents today are centered in discapacity, gerontology prevention and health issues. There is, though, an innovation challenge in moving towards a different model, centered in functional incapacity and active aging, allowing for learning activities and leisure, productivity and social participation.