The medical devices industry has experienced a significant upswing in recent years, and is considered (by some experts) the most dynamic sector within the Life Sciences. It is certainly a large market–estimated at $302 billion by 2017–with a high level of competition, rapid introduction of innovations and significant pressure to lower prices. Compared to the larger pharmaceuticals market, the medical devices market is more fragmented, has more diverse players, and has more opportunities for new entrants.

The estimated compound annual growth rate (CAGR) for the period 2011 to 2017, is estimated at 6.1%. Among its main drivers: new technological advances, the growing demand for more advanced equipment at lower costs, increased spending on health infrastructure, the demand for a higher quality of health care, and the prospects for expansion in emerging markets, such as India, China and Brazil. Moreover, the lack of homogeneity in the medical device regulations in different countries, and an increasing competitive environment could be included among the most important market forces.

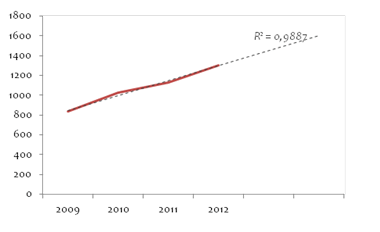

The dynamic nature of the industry is reflected in the growth of intellectual property patent and industrial design filings.

A search in the IFI CLAIMS Direct Global Patent Database, returns 109,289 documents for the period 1955-2013. 77% of the protected inventions have been filed in the last 10 years and 42.7% of them in the last five (2009-2013) In the period January-March, 2013, 2,288 patents/utility models have been published.

In order to identify and characterize the patent activity in the sector, this post describes the results obtained for the segment Devices / Surgical Equipment. In following posts, we will examine other niches, such as the diagnostic devices, cardiovascular devices and those used in diabetic patients. All of these segments reflect the technological convergence between diagnostic devices, monitoring and treatment.

New Technologies in the Surgical Devices Industry

The surgical devices market is very attractive. In the U.S. approximately 48 million surgical procedures are performed each year. These are valued at $9.2 billion in 2011, with forecasts to reach $11 billion in 2016. The growth rate (CAGR) is between 3.6%and 4.2% in the period 2011-2018. Its main growth drivers are: the rise of health care spending and the improvement of health infrastructure in emerging and vastly populated countries, especially India and China, the increasing incidence of diseases developed by the spread of Western lifestyle and the growing demand for technological innovations by professionals (surgeons). These technologies include devices for minimally invasive procedures (e.g., catheters, balloons and guidewires, used in angioplasty interventions).

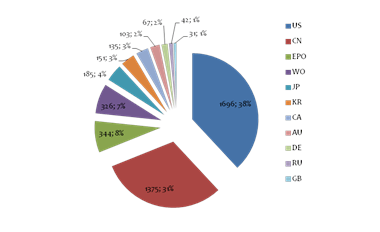

Patents applications appear for 25 patent offices. Figure 2 shows the 11 offices that concentrate more than the 98% of patent applications. As shown, The USA and China dominate the entry of new technologies in the sector, followed by Japan, South Korea, Canada and Australia.

Figure 2. Distribution of patent applications by patent office.

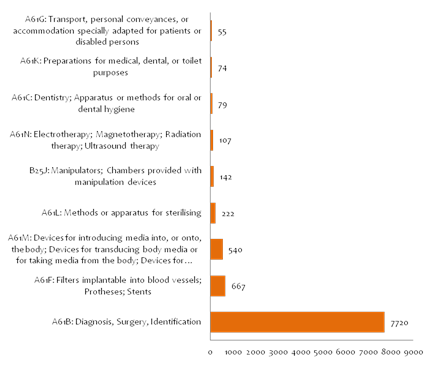

Surgical Device patents are classified in 1,116 IPCs (International Patent Classification codes), where A61B is by far the most frequent subclass. This is the subclass related to “Diagnosis, Surgery, Identification”. This is followed by subclass A61F, specifically related to filters or implantable devices. Figure 3 shows the most important IPC Groups. Each of these reference at least 200 patents.

Figure 3. Main categories (IPCs) in which patents are classified.

Excluding generic IPCs (A61B001700and A61B001900) thetopics discussed in a larger number of protected inventions related to "surgical devices", are: Surgical cutting instruments (A61B001732) and needle puncture trocars (A61B001734) surgical clamps (A61B001728) probes or electrodes (A61B001814); internal fixators(A61B0017068) and Surgical devices for suturing wounds(A61B001704).

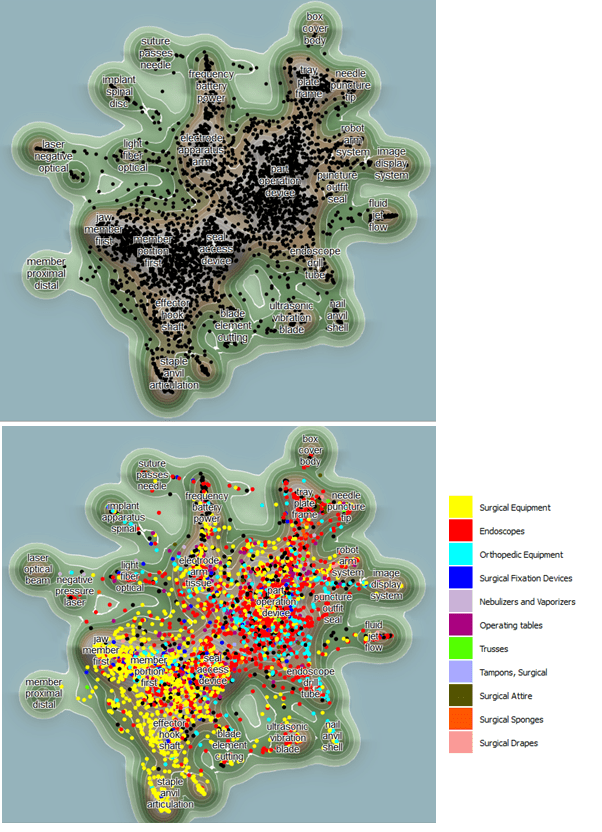

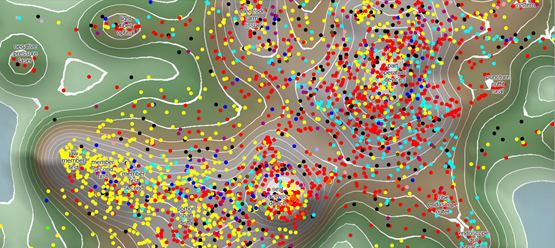

Figure 4. Complete Collection of Patents (top), and complete collection after KMX classification (bottom).

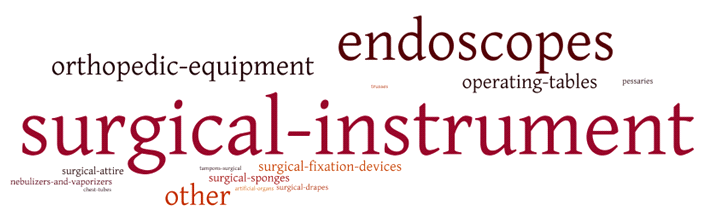

An alternative method of classification can be obtained using the KMX Patent Analytics tool. KMX uses Support Vector Machine based machine learning algorithms to classify documents based on a training set. In this case we used the thesaurus from PubMed, specifically the section Surgical Equipment. This gives us a convenient reference subject classification for the training and automatic classification of 4,509 patents. This illustrates how KMX allows the user to define his or her own classification system independent of the IPC or US classification schemes. After creating a training set, creating a classifier and applying the classifier to 4,509 patents, we get the results shown in the Figures 4 and 5.

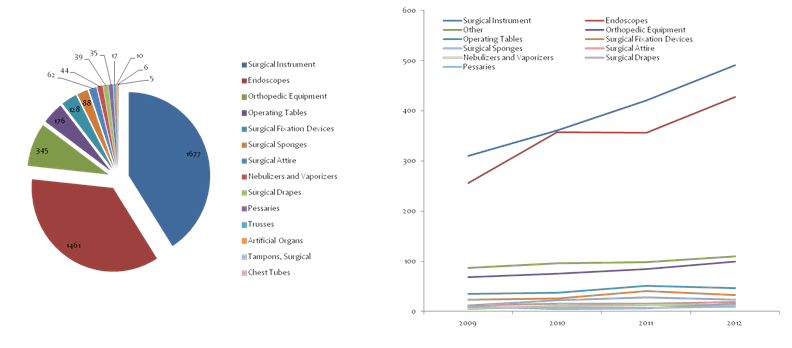

Figure 6, below, shows the distribution of patents annotated by classification and their evolution during the period 2009-2012.

Other areas with large and growing numbers of patents are: Orthopedic Equipment, Fasteners, surgical sponges, surgical Vests, Nebulizers and Vaporizers, and drapes.

Figure 6. Distribution and Evolution of Patents, according to the classification of thematic Pubmed MESH.

When looking at the most recently patented inventions (published in 2013) and classified under "surgical instruments", these are primarily related to: “equipment for musculoskeletal surgery especially knee surgeries and femoral, image based analysis equipment, and electrocautery devices”.

2013 "endoscopes" patents are related to: laparoscopy, ultrasonic surgical instruments or guidance by image. Regarding prominent applications or therapies, the most cited are: buccodental (jaws and throat), neurosurgery, gynecology, obstetrics, lymphatic system, gastrointestinal system (transanal or anorectal, gastroscopy) and pneumoperitoneum, among others.

In the category of orthopedic equipment, patents filed in 2013 relate primarily to: alignment and drilling devices, spinal disc space surgery, patella surgery and minimally invasive surgery techniques.

This year’s patents in "fixation devices" claim the following types of equipment or applications: ultrasonic surgical instruments, delivery devices for eye implants and devices for soft tissue fixation.

Using a simple patent search and KMX, we have quickly produced a snapshot for patents on medical devices and especially in surgical equipment. This snapshot highlights the great diversity of device innovations and applications, and corroborates the main market trend towards minimally invasive surgery. In upcomimg posts, Iale will look deeper into this attractive sector.