Leveraging Patent Data for Competitive Intelligence

Guest post from Tony Afram, Founder and CEO of ipQuants

With the abundance of online information available today, it is possible to get an understanding of your next negotiation counterpart by quickly looking them up on LinkedIn. It takes only a couple of minutes, and, more importantly, it is as easy as going online. Even senior executives regularly check into LinkedIn, despite their busy schedules. Conducting a pre-check makes them feel well prepared and gives them the confidence that they can ask the right questions and focus on the right topics.

However, when it comes to understanding the patent activity of our competitors or trying to identify a relevant collaboration partner, senior executives feel overwhelmed. They most often defer to the patent department or the patent search expert. True, basic top 10 patent search results for a particular technology sector are easily accessible online. However, the days in which such information alone was sufficient to feel well prepared are long gone.

On the other hand, patent search experts don’t really get the guidance they need when first asked to do a “patent search”. Like any other competitive intelligence task, the way a search is approached is heavily dependent on the type of questions we want to have answered. Often, however, senior executives don’t fully understand the wealth of insights that can be extracted by studying the patent portfolio of a competitor. The prep work required by the search expert to get clarity from the executive as to what the search “should focus on” can therefore be rather time consuming and frustrating. More often than not, this leads to the search being put on hold.

Does it have to be so complicated? An obvious question decision-makers would like to be answered with regard to their competition is: what has my key competitor really been up recently to and what are they focusing on? This is traditionally a very time-consuming task for the patent search expert, since growth rates analysis of patent filing activity usually does not come out of a box. But what if it did?

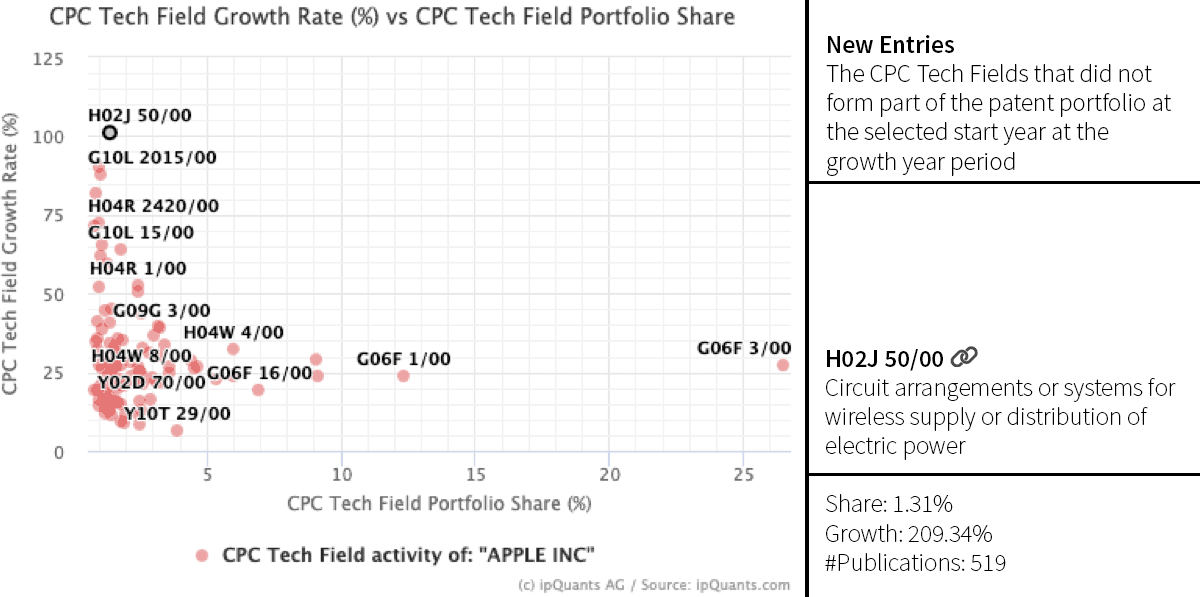

Clustering Apple’s patent filings by (CPC) technology areas is not difficult. However, what if you wanted to understand the 5-year growth rate by specific technology area for Apple Inc?

The chart below visualizes the growth rate of each Cooperative Patent Classification (CPC) tech area on the y-axis, while the x-axis identifies the Apple patent portfolio share of each identified CPC area.

It follows that approximately 26% of all Apple patent applications for the specified time period (not shown) are allocated to the tech area G06F3/00, which relates to input/output data transfer arrangements (see G06F 3/00 and subgroups). This is obviously no surprise as Apple is a computer software and hardware company. However, what the chart clearly tells us is that this tech sector is not the fastest growing tech field within Apple’s portfolio.

The tech area seeing highest growth rate for patenting activity is circuit arrangements for wireless supply or distribution of power as indicated by plot H02J 50/00 (and its subgroups). It remains to be seen if this activity will lead to a significant share of the patent portfolio over time, or if it was just a one-time activity that created a lot of patent filings.

But why stop there? The next obvious question the decision-maker usually has is, who else is playing in this field?

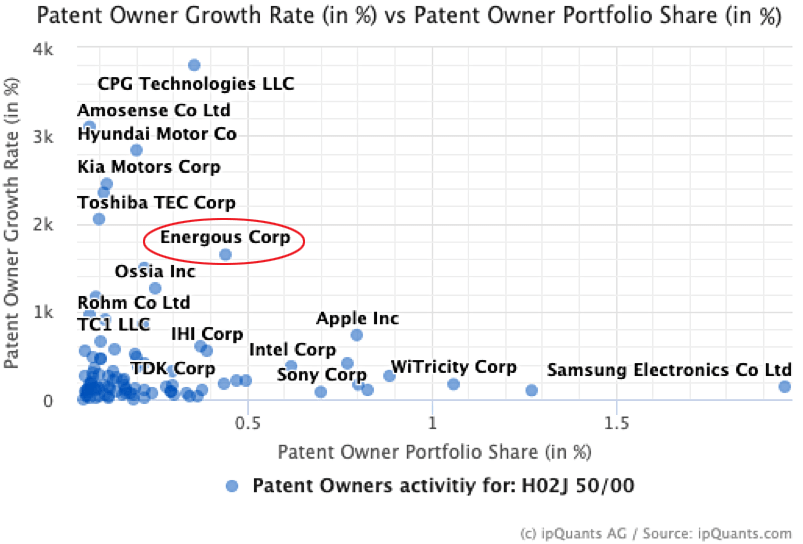

Conducting a similar growth rate analysis for the main patent owners yields the results below. While Samsung holds the largest share of patent applications within this CPC tech area, it is a company named Energous Corp that is one of the fastest growing within this segment. The visualization below enables the decision-maker to quickly identify new potential collaboration partners or targets.

Best of all? Time to insights was less than 1min. From starting with Apple to identify the fastest growing tech areas within Apple’s patent portfolio all the way to identifying a list of potential collaboration partners or targets, took less than 1min. The decision-maker can now instruct the patent searcher with greater confidence to conduct a deep-dive into both the tech area and some of the identified companies, and the patent searcher is armed with more relevant instructions from the start.

For big data analysis to really start being valuable to senior executives, the focus must be to arrive at strategically relevant insights almost instantly, as shown in the above example instead of overwhelming the decision-maker with data-points and KPIs that take too much time and effort. When kicking-off a competitive intelligence project, making it as easy as possible to get the initial results can make all the difference.