Advancing AI

Artificial intelligence is a big tent technology with many segments.

Since late 2022 when ChatGPT made its entrance, the slice of the AI arena that has captured the public’s attention is generative AI and its ability to create content that feels almost—or perhaps utterly!—human.

While the world remains enamored with GenAI, the field has continued to push boundaries. The current outer limits of development are coalescing around a subset of GenAI called agentic AI. What’s the difference? Agentic AI is more than just training on data and production of content. In this AI iteration, an “agent” learns from the past and, as such, can improve its performance in the future. Agents are even more human-like in that they can process data, reason, adjust to change, and then act without added human input guiding them.

Companies are starting to see the potential in workers having “assistants” to help them complete tasks, freeing employees to do higher level work. CRM provider Salesforce, for one, rolled out an AI assistant system called Agentforce last October. The platform helps clients in the medical field, for example, manage patient data. In other industries, it can offer a sales pitch or generate promotions.

Here at IFI CLAIMS, we’re always looking for signals in patents to leading edge technologies. Agentic AI is still nascent and has a long way to go, but with any revolutionary technology, it’s always worth knowing who the first movers are when it comes to protecting inventions. We did that last year with an analysis on GenAI. Because the AI landscape is shifting rapidly—and that’s not even factoring in the market shocks of tariff volleys—we decided to take another look to see what has changed in the year or so since we last looked at the field. Here’s our breakdown of the competitive landscape— along with some additional analysis on OpenAI and DeepSeek, which surprised the markets in January while we were researching this topic. DeepSeek also showed the world how the AI competitive picture can change in an instant. Results below:

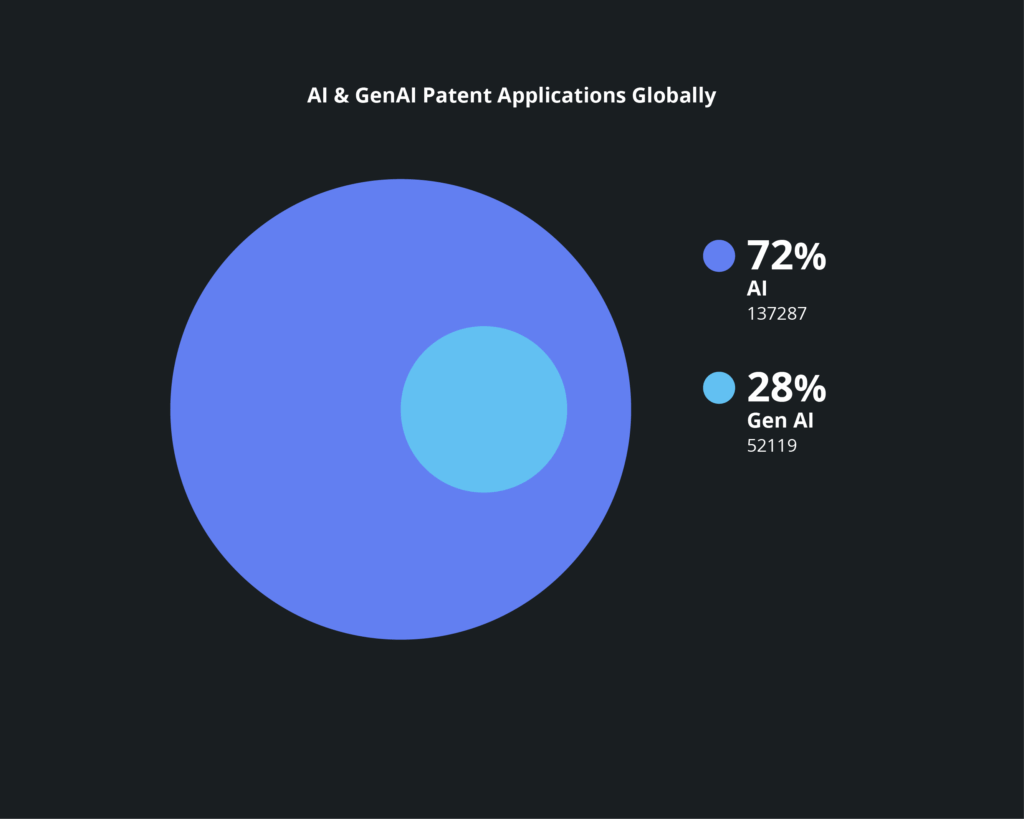

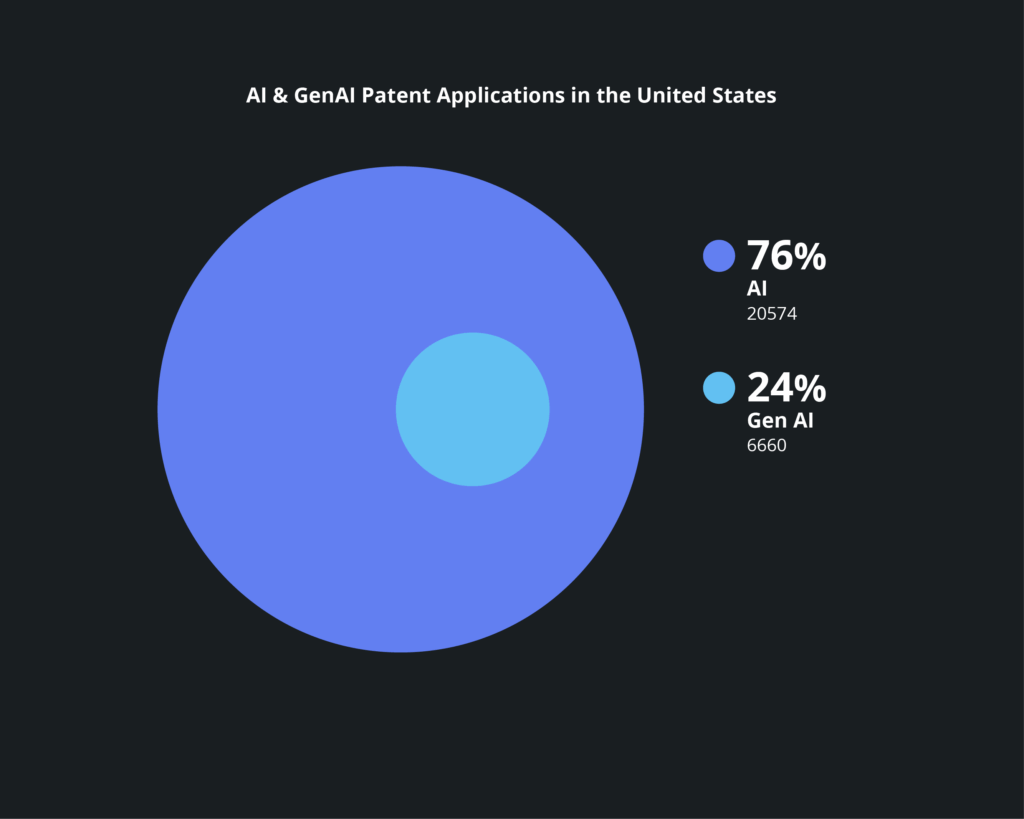

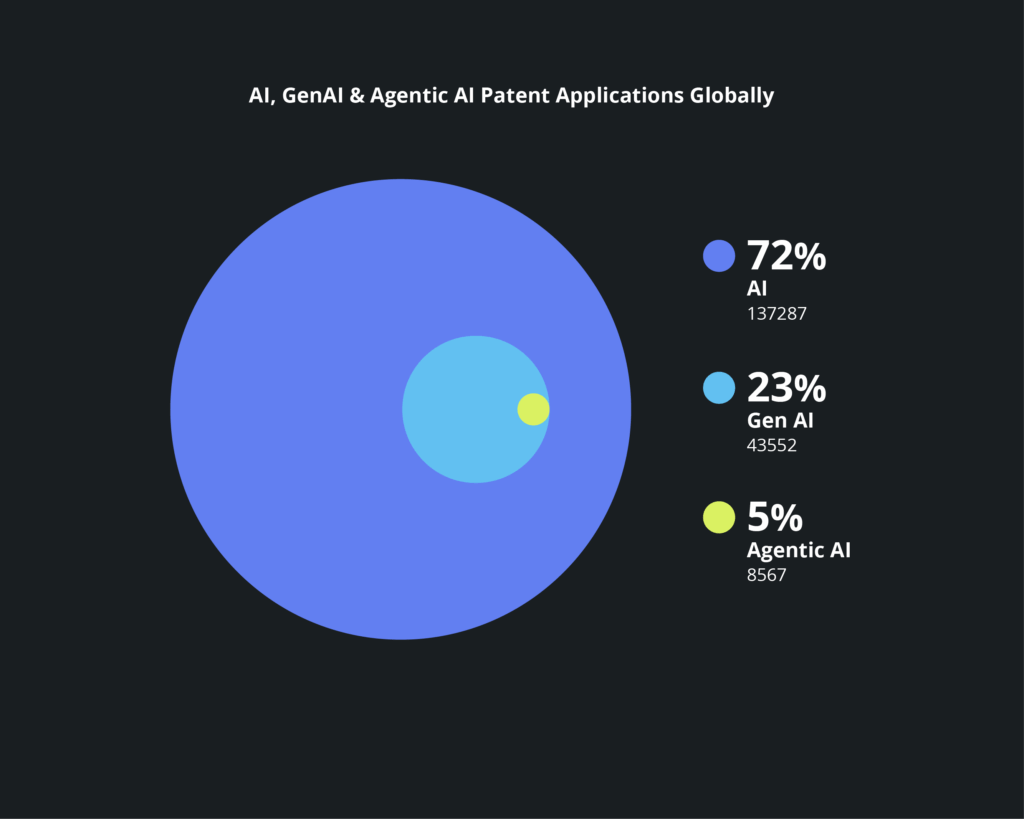

Generative AI’s portion of the AI patent pie

IFI searched patent application documents over the past fourteen months to get a sense of the space that generative AI is taking up in the wide-ranging artificial intelligence picture. Overall AI patent classifications incorporate such technologies as machine learning, artificial neural networks, natural language processing, and computing based on biological models. Patent taxonomies for GenAI—applications that create text, video, images, and audio—include large language models with word-embedding architecture, adversarial networks, and neural networks called generative pre-trained transformers (which is where the acronym GPT comes from). Of the nearly 190,000 global applications found in the time frame, 28% can be classified as GenAI. Looking at applications presented to just the USPTO, 24% of these patents are considered GenAI, just a bit higher than last year’s inaugural survey of the space.

AI patents looking up

Over the past 10 years, the trendline for both AI and GenAI patents has headed upward. AI grants have grown at a compound annual rate of 38%, while applications have expanded by 31%. For GenAI, the line is even steeper, with grants increasing at a rate of 58% and applications rising by 52%.

Evolution of AI Patents

Evolution of Generative AI Patents

Google’s AI patents rule

Any way you look at AI patents over the time frame, Google leads. Globally, the search giant notched 1,837 AI patents, ahead of Samsung and Huawei. Google holds some 50% more than Microsoft and nearly double IBM on the world stage. Here is an example for one of Google’s AI patents for training neural networks to perform machine learning tasks.

When it comes to generative AI patents, Google may be the frontrunner, but Microsoft, IBM, and Nvidia hold strong positions as well. This patent from IBM protects speech to text touchscreen graphics rendering. And this patent pending from Nvidia covers human demonstrations of a task when training machine learning models.

Top AI Applicants Globally

Top AI Applicants in the United States

Top Generative AI Applicants Globally

Top Generative AI Applicants in the United States

GenAI patents’ component parts

Generative AI burst on the scene in late 2022 with the introduction of ChatGPT. But the patent class laying the foundation of GenAI is a fast growing technology that has been on IFI’s radar for a number of years. It’s called “computing arrangements based on biological models,” which has helped advance the fields of medicine, microbiology and virology as scientists use data and computational power to model and predict how organisms will react under various conditions. Deep learning, such as the type needed in convolutional neural networks, is one of the fundamental technologies of this class. It helps machines figure out content in ways similar to human reasoning, which is why GenAI patents place stakes in this arena. As for other supporting technologies, notice that the capabilities lie in “recognition,” “analysis,” and “understanding.” All of which suggests cognitive capacity.

Talkin’ bout AI generation

As GenAI investment has gained momentum in the market, companies like Nvidia and Google have been placing their greatest patenting focus over the past year on inventions protecting the cornerstones of the technology: image, speech, text, and video creation. The chart below illustrates which companies are placing the most emphasis on these four GenAI bases. Nvidia leads in video and image; Microsoft is tops in text, and Google is the speech frontrunner. It’s important to note that most of these companies are likely to protect in each arena, but not all are making each of the four areas their prime focus. IBM is putting much of its patenting effort into speech, text and video, while Adobe’s primary concentrations are images, text and video. This patent from Adobe protects its method for generating a design document from a text prompt.

Intel, the chipmaking colossus that missed the boat and lost its market luster over time, looks to be lagging in its GenAI focus, compared to rivals, over the past year—a difficult year for the company on many fronts. While Intel is positioning its top patent strategies on images and video protections, it doesn’t have nearly the focus that others have in the area. That’s not to say Intel is out of the game; the company is making strides on other types of AI, as noted below.

Generative AI Patents by Applicant and Focus

Public agent patents

As if GenAI isn’t human-like enough, agentic AI is the latest frontier in the vast artificial intelligence landscape. The technology is still very nascent, and thus not exactly reliable, but the hype around this autonomous AI technology—capable of reasoning and adapting to new environments, planning and executing workflows—is mounting. And the potential applications for agentic AI in such industries as healthcare, finance and transportation is promising, once the technology is more developed. Within the universe of AI patents around the globe, the footprint for those claiming agentic novelties is relatively small at 5%. Among U.S. applications over the past year, agentic properties comprise 7% of the space.

Patent claims agent

In worldwide applications this past year, Google is the leader in agentic patents, followed by Nvidia and DeepMind. In the U.S., Google and Nvidia are again in first and second place, followed by IBM. It’s also worth noting here that in the U.S., Intel is ahead of Microsoft when it comes to agentic AI patents. This recent agentic patent from Google is for a conversational interface. And this pending patent from Nvidia protects a prompt generator with processes that can be performed by an agent.

Top Agentic AI Applicants Globally

Top Agentic AI Applicants in the United States

Deep dive on DeepSeek patents

During the early stages of gathering research for this report, a Chinese company called DeepSeek made a dramatic appearance in January with an AI model that the company said was as good as one of OpenAI’s reasoning models—at a fraction of the cost. Stock market carnage in response to the potential of this threat was steep—plummeting some $1 trillion in a day (about $600 billion of that was from Nvidia).

So we decided to take a look at DeepSeek’s patent portfolio. We wanted to see whether this upstart, powerful enough to make the market quake in its boots, had any patents. We found one application from March of 2024: a construction method for an AI model training data set. Notice that Beijing DeepSeek Artificial Intelligence (a subsidiary of Hangzhou DeepSeek Artificial Intelligence) has patented with a small host of other related companies—a practice not uncommon in Asia, particularly in India and China. It’s also worth noting that these co-patenters have equal rights to this technology—a small, but important detail for any investor looking for new opportunities. It’s hard to say what DeepSeek’s protection strategy is at this point because one patent can’t give much of a picture. The company may be relying on trade secrets. Or more patent applications could be in the pipeline. So far, DeepSeek, and its related companies, are protecting inventions only in China.

We can gather clues by looking at the technologies a patent is covering. The main classification for this patent is G06N 5/00, which centers around extracting rules from data. It’s not a lot, but whatever DeepSeek’s overall patent strategy, this particular technology is so important to the company that it is seeking protection.

Although there is currently only one DeepSeek patent to examine, we can look at the group of DeepSeek partners in order to see what technologies they’re pursuing. It’s fair to assume that DeepSeek is likely interested in the same areas. We found 26 patents. Below are the top tech areas. Number one is G06F 9/4881, which revolves around program initiating and switching. Machine learning is also up there. As is G06F 9/5038, dealing with multiprogramming and allocation of resources.

Top CPC Codes for DeepSeek and Co-patenters

Opening the patent picture on OpenAI

When IFI CLAIMS performed the first scan of OpenAI last year, we found fewer than five patents, which we thought was surprising for a company so innovative. We speculated that the creator of ChatGPT could be leaning heavily on trade secrets to protect its innovation. This year, our analysis shows OpenAI is much more active in protecting their inventions with patents; we found 39 on this most recent check, which aligns with the company’s acknowledgement of “the role that patents play in the technology landscape,” according to a statement on its website. The company seeks patents both in the U.S. and around the world. The top technology the company is chasing is machine learning, as well as G06F 40/30, a class dealing with discourse and dialog representation. It’s also inventing around arrangements for software engineering in program documentation and creation of source code. Information retrieval and neural networks are additional key technologies for this startup. OpenAI says it will use its patents only for defensive purposes—“so long as a party does not threaten or assert a claim” against the company.

Top CPC Codes for OpenAI