The Top 10 Fastest Growing Technologies of 2024

The emerging technology story in 2024 was dominated by one galloping advancement: artificial intelligence.

Since 2016 IFI CLAIMS has combed through a running five-year accumulation of patent applications to come up with our annual ranking of the 10 Fastest Growing Technologies. The list has become an important tool for investors attempting to discern the shape of trends and for companies trying to understand the competitive landscape.

And though AI was the big technology everyone was chasing for the second year in a row (ever since the introduction of ChatGPT in late 2022), the technologies around AI—such as machine learning, and computing arrangements based on biological models—do not appear on our list this year. They have shown up on previous rankings over the past eight years though. Any prudent, astute investor would have seen the seeds of our current global AI boom in the patents long before the present iteration took the world by storm.

Our list is based on applications in the public domain, not granted patents. Applications are the best proxy for technologies to come because there is less of a time lag between submission to publication than submission to grant, which can take years. AI is here. It’s now. The patent applications have been signaling this trend for years, and they have now ripened into actual products. So we may not need the intense inventive efforts of deep learning architectures, for instance, because the foundation of that technology was laid and protected years ago with patents, and now they are simply becoming more and more efficient. And that’s the other thing about being a fast-growing technology. Once that technology starts arriving—as it has with AI—fruition means slower growth. So we’re not surprised to see that something like machine learning has fallen off our top ten this year.

The good news is that there are plenty of other technologies that companies are investing in. It’s not all about AI. Which is encouraging because the world requires continuing invention in the fields of computing, biotech, data privacy and security, networking capabilities, space technology, and so on.

Themes are abundant on this year’s list. No fewer than three of the top 10 technologies are devoted to reducing waste. That’s a heartening happenstance as society continues to grapple with sustainability and achieving net zero. Speaking of sustainability, another top technology innovates around non-animal-based protein. Electrolytic cell technology makes a big showing this year, taking up three places in the top ten. We may not have been surprised to see machine learning fall off as we said, but we were surprised by the disappearance this year of one perennial old-economy technology that has long been on our ranking: Cigarettes—yes, the old-economy kind. We’re not convinced they’ve been relegated to the ash heap though. Big businesses with lots of pricing power have abundant reasons to keep pouring resources into R&D. Plus, the technology came in at Number 11, so it could easily re-emerge in future years.

Read on for IFI’s Top 10 Fastest Growing Technologies, along with charts that put the data into perspective.

U.S. Applications: 2024 Count and Growth from 2019 to 2024

Bubbling Up

Searching all published patent applications in the U.S. over the past five years, we determined the frequency of patent codes requested over that timeframe. We then calculated the compound annual growth rate (CAGR) of those technologies to come up with our list of fastest growers. The scatterplot above represents the total number of patents and the growth for each technology. The top technologies will appear further up and toward the right. The chart is interactive. Click on the circles to delve into further details of each code.

Evolution of Tech Over Time

Fast Growth Technology Wavers

Inventions are categorized into nine groupings depicted above: human necessities, performing operations/transporting, chemistry/metallurgy, textiles, fixed constructions, mechanical engineering, physics, electricity, and a catchall classification called new technological developments. Of the more than 3,000 technologies IFI CLAIMS examined, only the chemistry/metallurgy category grew in the five-year time span. The biggest decliner was Y, which fell by 24.4%.

10 Preparations for Use in Therapy

CPC Code: A61K 2121

Patents for the Cure

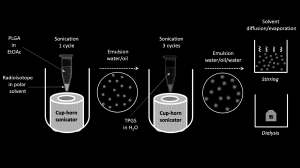

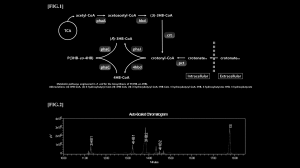

This patent classification covers the origination and prescription of biologically derived therapeutics. In short: formulating and administering protein-based drugs directly into a living organism. Inventions in this capacity include enhancing absorption or precision aimed at particular tissues. The overall growth rate for the technology: 17.5%.

At the head of this class is a company that spun out of the University of Tübingen, Germany in 2000; biopharmaceutical Immatics has applied for the most patents (226) with this technology over the past five years. It specializes in using T cell immunotherapies to target cancerous tissue while leaving healthy cells alone. The University of Texas holds the second highest number of patents, with 144. Big hospitals are also patenting in this area. Memorial Sloan Kettering Cancer Center and Seattle Children’s Hospital are among the most active filers.

Leading Applicants in A61K 2121

Growth in A61K 2121

9 Destroying Solid Waste

CPC Code: B09B 3

Waste Management

Convenience in a modern world where people seek to save time comes at a steep cost to the environment. We like the ease of disposable things—from cutlery to containers for single-use beverages. The patent class surrounding destroying solid waste also covers the transformation of that waste into either something useful or at least harmless; the class covers everything from disposal of asbestos and medical waste to melting, softening, compressing and absorbing the discarded. Basically, it catches the inventions for treating forms of waste that aren’t mechanical or biological (those methods have their own classifications). Code B09B 3 has been growing at a rate of 17.7%. Unicharm, a Japanese company that specializes in disposable personal hygiene products, has been applying for the most patents in this space, with 187 over the time span.

Leading Applicants in B09B 3

Growth in B09B 3

8 ssRNA Viruses Positive-sense

CPC Code: C12N 2770

Viral Patents

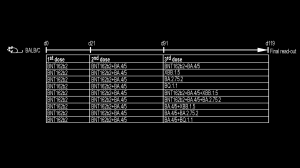

Positive-sense single-strand RNA viruses encompass about a third of viruses. Hepatitis A, Dengue, rhinoviruses, West Nile and COVID-19, which afflicted the globe over the past five years, are some examples. With a growth rate of 17.9%, this class has proliferated dramatically, likely because of the pandemic. C12N 2770 is a class that covers the introduction and manipulation of genetic material using DNA or RNA. Global biopharma GSK has applied for the most patents with this technology. The company’s most recent annual report touts its research and development in RNA knowhow. Takeda Pharmaceuticals is also inventing in the area, as is the U.S. Department of Health and Human Services and BioNTech, the company with pioneering mRNA technology used in partnership with Pfizer to bring COVID vaccines to the market. Here is a BioNTech patent using RNA to treat or prevent coronavirus (US-11878055-B1). It was filed in 2023 and granted in 2024.

Leading Applicants in C12N 2770

Growth in C12N 2770

7 Microorganisms; Processes Using Microorganisms

CPC Code: C12R 2001

Microbial Growth

Microorganisms, undetectable without the help of microscopes, have a multitude of beneficial uses: fermentation of food products, keeping water clean, advancing scientific research, among many others. Harmful microbial agents, on the other hand, can cause any number of diseases. Whatever the microorganism, the field of study and invention is crucial to producing enzymes and antibiotics, for instance. Patent code C12R 2001 is related to specific strains of microorganisms and their accumulations in a culture. The category has grown at an annual rate of 18.6%, though a particularly large jump of 28.5% occurred between 2023 and 2024.

Leading Applicants in C12R 2001

Growth in C12R 2001

6 Electrolytic Production of Inorganic Compounds or Non-metals

CPC Code: C25B 1

Applied Chemistry

Chemical reactions using electrolytic methods for building inorganic compounds are the stuff of patent classification C25B 1, growing at a rate of 19.1%. Inorganic compounds are non-carbon-based and include substances like hydrogen, ammonia, silicon, halogens, metal oxides, and hydroxides. This patent class covers electrolytic processes that yield the inorganic outcome. One simple example to illustrate: producing sustainable fuel and hydrogen through electrolysis. Japanese electronics company Panasonic is the dominant player in the patent arena with 469 patents over the past five years. Toshiba and Honda are also patent heavyweights in this area and more areas to come.

Leading Applicants in C25B 1

Growth in C25B 1

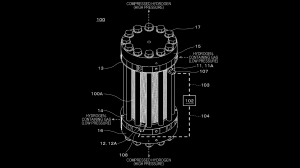

5 Cells or Assemblies of Cells; Constructional Parts of Cells; Assemblies of Constructional Parts, e.g. Electrode-diaphragm Assemblies; Process-related Cell Features

CPC Code: C25B 9

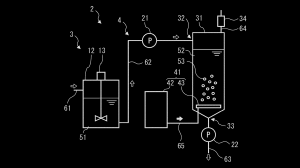

Cell Structure

So many inventions are the product of both the physical nuts and bolts and the more methodological processes of creating something new. In this year’s ranking of the 10 Fastest Growing Technologies, electrolytic methods are a big deal and take up three positions on our list (see above, see below for more details). The category of C25B 9, with a CAGR of 20.5%, covers the physical composition of electrolytic cells, not the processes. The hardware, so to speak, which includes cell housings, electrode-diaphragm assemblies, and connections within the cell. Just as we saw above, Panasonic is the leading applicant in this space with 436 patents over the last five years, followed by Toshiba (390). This 2024 application from Panasonic (US-20240301570-A1) for a compression device that includes an electrochemical cell with an anode and a cathode enveloping and electrolyte membrane is currently pending.

Leading Applicants in C25B 9

Growth in C25B 9

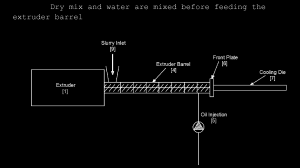

4 Working-up of Proteins for Foodstuffs

CPC Code: A23J 3

High Protein Patents

Some 100 million people around the globe enter the ranks of the middle class each year. With more disposable income, nutritional demand for animal protein increases, making goals around climate and sustainability more difficult to achieve. This year, a patent class called “working-up of proteins for foodstuffs”—yes, that’s a mouthful of awkward words— makes its debut on our ranking at Number 4, growing at a rate of 22.6% over the previous five years. The class revolves around extracting protein from non-traditional sources for use with humans or animals. In other words, it’s not about making milk, meat, or eggs yield more, but rather about using techniques to extract and modify protein from non-animal sources and make these nutritional building blocks more productive in the body. Nestle, the world’s largest food and beverage company, is the most active patenter in this field and has a portfolio of products around non-traditional protein. In India, Maggi Nutri-licious Chatpata Besan Noodles uses chickpea flour as a main component in the recipe. In Chile, Nestle introduced a soy and spice product called Maggi Rindecarne last year as a meat extender. And in Africa, a package of Maggi Soya Chunks packs enough protein for eight people. This Nestle patent granted last year (US-11882851-B2) protects a process for preparing a product that has the look and feel of meat.

Leading Applicants in A23J 3

Growth in A23J 3

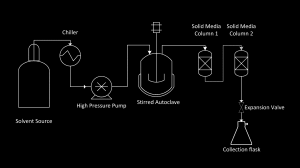

3 Recovery or Working-up of Waste Materials

CPC Code: C08J 11

Waste Not

The notion of a circular economy, a pattern of use that extends the lifecycle of products and limits waste, is a worthy goal that seems ever out of reach. The stream of waste in the U.S. grew to 292.4 million tons in 2018, according to the most recent numbers from the Environmental Protection Agency. That’s 4.9 pounds per person per day, up from 4.53 from the previous year. So the production of waste isn’t heading in the right direction. And while recycling has certainly made strides over several decades, in recent years, the recycling and composting rate has dipped to some 32% of waste, down from 35%. So it’s heartening to see the patents surrounding the recovery of waste materials ranking third on the list, increasing at an annual rate of 26.1%. Technologies in this area cover the breaking down and reuse of materials like plastic and rubber using temperature and chemicals. Eastman Chemical is the frontrunner in this arena with 239 patents. Eastman has developed two types of molecular recycling: polyester renewal technology, which takes such items as carpet and clothing and reduces them to monomers, and carbon renewal technology which takes plastic waste and converts it to molecules which can be used in new products. But this form of recycling isn’t immune from criticism. A new Eastman molecular recycling facility in Kingsport, Tenn, drew ire last year from environmentalists who called the process hazardous.

Leading Applicants in C08J 11

Growth in C08J 11

2 Working up Raw Materials Other Than Ores, e.g. Scrap, to Produce Non-ferrous Metals and Compounds Thereof

CPC Code: C22B 7

Metal Work

Patent code C22B 7 centers around recovering alloys from scraps that aren’t made of iron. Common types: copper, aluminum, lead and zinc. In other words, it’s a recycling patent classification with an emphasis on specific metals. According to the EPA’s most recent numbers, nearly 1.7 millions tons of non-ferrous metal were recycled in 2018; unfortunately, 740 million tons ended up in a landfill, a statistic that should diminish if patents under this classification keep growing. In addition to scrap, reclaiming non-ferrous metal can come from residue, waste, or industrial dregs. The technology covers separation and salvage processes. As societies look toward sustainability, salvage technologies and operations continue to gain traction. This patent technology rose by 26.2% over the time period.

Leading Applicants in C22B 7

Growth in C22B 7

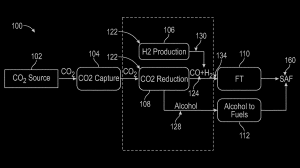

1 Operating or Servicing Cells

CPC Code: C25B 15

Toshiba: The Electrolytic Company

This year, IFI CLAIMS has a new first place finisher in our list of fastest growing technologies: operating or servicing cells with a CAGR of 27.2%. This technology, in essence, revolves around building cells in a way that makes certain that the end products are separate—for instance, dividing water into hydrogen and oxygen. Toshiba is the top applicant in this technology with 316 patents over the past five years, followed by Panasonic (270) and Honda (258). Two years ago, Toshiba developed a large-scale, more efficient power to gas technology for electrolysis electrodes that reduces the use of iridium, one of the earth’s rarest metals. Additionally, Toshiba’s power to chemicals process converts CO2 to carbon monoxide using electrolysis. The company’s aim: expanding its footprint in carbon neutrality.

Leading Applicants in C25B 15

Growth in C25B 15