EVs have officially gone mainstream

Consider 2021 as the year that electric vehicles have finally been accepted by the mainstream as the future of transportation. After years of Elon Musk and Tesla’s lonely race to cultivate and prove a broad market for EVs, last year was studded with a procession of announcements by legacy carmakers – GM and Ford, among others – with big promises backed by sizable investments in electrifying their fleets. Capping off the year was the IPO of EV startup Rivian Automotive, which got investors all charged up in the company’s early weeks of trading. EV, clearly, has arrived.

In light of the activity around the EV market and the ever growing investment in the sector, IFI CLAIMS, the industry’s most trusted patent data provider, performed a review of EV patent technologies and came up with a list of startups that could be in the crosshairs for future mergers and acquisitions. Highlights of IFI’s analysis are below:

Startup stars

First, IFI looked at the patents of companies that were considered attractive enough to acquire. Of startups scooped up in the past 10 years, Sakti3, an Ann Arbor, Michigan battery company acquired by Dyson in 2015, leads the pack with 69 patents granted. NovaTorque, a manufacturer of electric motors for industrial and commercial applications comes in second, followed closely by Finnish company Visedo, a developer of electric drive train components. Wireless Advanced Vehicle Electrification (WAVE), a Salt Lake City-based provider of wireless charging solutions for heavy duty EVs, holds 25 patents granted since its founding in 2011, though most of the patent activity has been quite recent (more on that below). WAVE was acquired in 2021 by Ideanomics.

Top Patenting (Acquired) Startups

What have you patented for me lately?

When it comes to technology, the recency effect is something to examine as an indicator of which companies have momentum. The chart below shows the sequence of patents filed in the last five years for the acquired startups that IFI reviewed. Looking at this patent grant evolution gives clues on the IP development pathways and strategies each company is pursuing. It also hints at which companies have been making recent advancements, and which companies might have stalled.

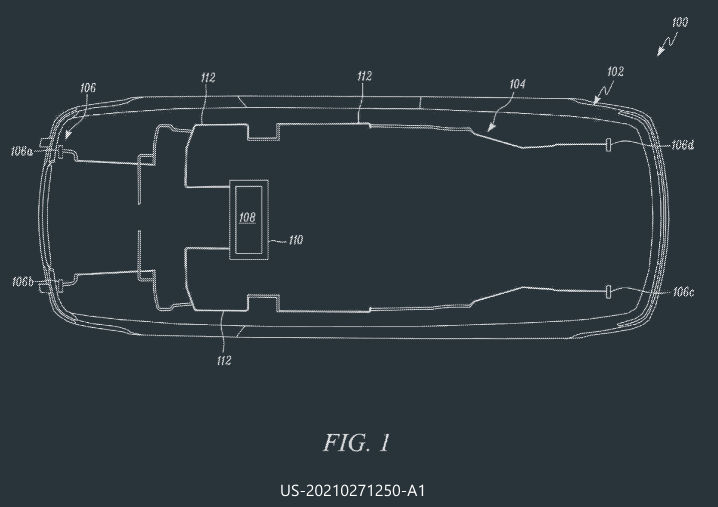

Cracking the patent codes for clues

Classifying invention is complex, which is why there are two major hierarchical systems in order to categorize methods, devices, and processes that have not previously existed. The first system is the International Patent Classification (IPC), used since 1971 and the second is the Cooperative Patent Classification (CPC), which started in 2013. IFI analyzed both classification systems to determine the technological inroads EV startups are making. The charts to the right show the top technologies of the acquired startups that IFI examined by code. Below are the definitions for both the top three IPC and CPC codes. You can also see them by hovering the mouse over any bar.

Top IPC Codes:

- G05D 1/02 – Control of position or course in two dimensions

- G05D 1/00 – Control of position, course or altitude of land, water, air, or space vehicles, e.g. automatic pilot

- H01M 4/04 – Manufacture of electrodes in general

Top IPC Codes

Top CPC Codes:

- Y02T 10/70 and Y02E 60/10 – Respectively correspond to climate change mitigation and GHG reduction technologies and specifically referring to Energy storage systems for electromobility, e.g. batteries and Energy storage using batteries

- H01M 10/0562 – Manufacture of secondary cells characterized by solid materials used as electrolytes

Top CPC Codes

Takeover targets?

After evaluating the patent classifications of previously acquired startups, IFI CLAIMS scoured its database for other startups working in the same technological spaces. We limited the search to companies with 50 or fewer employees that have filed at least two patent applications in the last two years. So which startups might be in play as potential acquisitions? We won't make any concrete predictions but by looking at the technologies EV startups are attempting to patent, we can spot other players in the space. For example, Polyplus Battery, Terrawatt Technology, and Soteria Battery Innovation are among the top filers in the area of EV batteries between 2017 and 2021. Nucurrent, and Solarlytics are top filers in energy storage during the same time frame. These companies certainly aren't household names, but their patent applications could attract attention from much larger investors. See below for other prominent EV patenting areas that IFI's research broke out:

Batteries

Energy Storage

Non-Electric Variable Control

Electric Vehicles

Traffic Control

Data Processing

Dynamo Machines

Measuring and Metering

Hybrid Vehicle Control Systems

Tackling range anxiety

Charging ahead

At the heart of electric vehicles, and renewables in general, is the system for storing energy: rechargeable batteries. Just as drilling for crude fueled the oil and gas industry for the past century and more, powering the EV industry forward has required enormous focus on rechargeable battery technology. The big automakers – Daimler, Toyota, Volkswagen, Audi and Ford – are steering plenty of their electric vehicle R&D into battery IP. So are players in the automotive parts and solutions area of the industry such as Denso, Vitesco, and Phoenix Contact.

Top Companies in Battery Charging Systems

Charged up startups

Considering how core rechargeable batteries are for the EV industry to flourish, investors will be keeping their eyes on the road for promising startups in this area. Here is a chart of the most active startups that are patenting in battery charging systems.

Top Startups in Battery Charging Systems

Patents on autopilot

Assessing patents in the EV industry wouldn't be complete without looking at the AV (autonomous vehicle) portion of the technology stack. Despite the money pouring into the technology and the fanfare whenever an autonomous vehicle advance – or failure – makes headlines, artificial intelligence and autonomous driving, while certainly on the horizon, are much further down the road when it comes to widespread use. Still, the technology is accelerating. Using patent classification codes related to autonomous driving, artificial intelligence and machine learning, we identified the top companies patenting in the space over the past two years. Naturally, global automakers are active in the space – Ford, Toyota, Kia and Hyundai, among others. Chipmakers Nvidia and Intel are also patenting in the area. Autonomous driving pure play Motional, a joint venture of Hyundai and auto supplier Aptiv, also figures prominently. Notably absent from the upper echelon: Tesla, which appears 23rd on the list with 11 patents in the past two years.

Top Companies in AI & Autonomous Driving

Autonomous up and comers

Could these startups propel autonomous driving forward? To the right are companies to keep an eye on, including top-of-the-list Boston-based Perceptive Automata, which uses behavioral science to train Al systems to “see” the intentions of pedestrians the way a human being would.

Top Startups in AI & Autonomous Driving

Startup acquisitions in the EV sector

IFI CLAIMS’ EV Industry Review is based on a compilation of 43 EV technology startups protecting their IP with patents that have been acquired in the past 10 years. Our researchers tallied the patent classification codes of the acquired entities and compared those findings to classification codes of EV startups that had not been acquired as of November 2021. We looked at EV startups with 50 or fewer employees. Patents are just one component of the due diligence needed to acquire a company, but patent activity is a valuable piece in understanding the scope and direction of a company's strategic technology development. Acquisition names and assignation data are shown in the table below.

The EV industry is just one example of the coverage that IFI CLAIMS includes. To create your own sector analysis, visit the IFI CLAIMS Live 1000, a free tool that uses data from the top 1000 companies that received US patents in 2021.

Disclaimers

- Employee count of startups are based on outside sources

References

- EV volumes. The Electric vehicle World Sales Database https://www.ev-volumes.com/

- Electric Vehicles are going to Dent Oil Demand - eventually (2021-12-09) https://www.bloomberg.com/news/articles/2021-12-09/peak-oil-demand-is-coming-but-not-so-soon?sref=JMv1OWqN&s=09

- Nordic EV Outlook (2018-05) https://www.nordicenergy.org/wp-content/uploads/2018/05/NordicEVOutlook2018.pdf

- Norway Over 90% Plugin EV Share In November – Legacy ICE At Record Low (2021-12-03) https://cleantechnica.com/2021/12/03/norway-again-over-90-plugin-ev-share-in-november-legacy-ice-at-record-low-5/

- Lucid Motors passes Ford’s market cap four years after it nearly got bought (2021-11-16) https://www.theverge.com/2021/11/16/22784017/lucid-motors-valuation-ford-spac-air-sedan-deliveries

- Shares of EV maker Lucid slide after disclosing SEC subpoena (2021-12) https://techxplore.com/news/2021-12-ev-maker-lucid-subpoenaed-sec.html

- Feds Lend Tesla $465 Million to Build Model S (2009-06) https://www.wired.com/2009/06/tesla-loan/

- Building the Ultimate In-Cabin Experience with Renovo and Affectiva (2018-05-08) https://blog.affectiva.com/building-the-ultimate-in-cabin-experience-with-renovo-and-affectiva

- Tesla vs. Lucid: Here’s how the EV rivals are and aren’t alike (2021-03-02) https://www.cnbc.com/2021/03/02/tesla-vs-lucid-heres-how-the-ev-rivals-are-and-arent-alike.html

- Tesla opens Superchargers to other electric cars for first time (2021-11-02) https://www.theguardian.com/technology/2021/nov/02/tesla-opens-superchargers-to-other-electric-cars-for-first-time